A pre-release variation of Apple Pay Later on continues to present to arbitrarily picked iPhone users, as kept in mind by tech lover Will Sigmon Constructed into the Wallet app, the “purchase now, pay later on” function lets certifying clients divided a purchase made with Apple Pay into 4 equivalent payments over 6 weeks, without any interest or costs.

iPhone users will see an “Early Gain access to” banner for Apple Pay Later On in the Wallet app if they are picked, and a notification will be sent out to their Apple ID e-mail. There does not seem any method to require a welcome, however those who want to attempt Apple Pay Later on need to be a U.S. local, 18 or older, and upgrade their iPhone to iOS 16.4 or later on.

Apple Pay Later on early gain access to started in late March, and Apple stated it prepares to provide the function to all qualified users “in the coming months.”

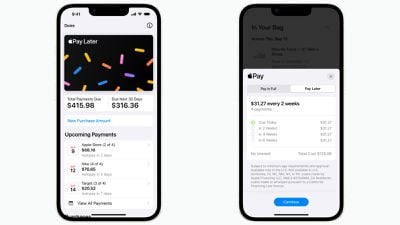

iPhone users can obtain a $50 to $1,000 loan in the Wallet app without any effect to their credit, according to Apple. After getting in the quantity they want to obtain and accepting the Apple Pay Later on terms, a soft credit check will be started. When a user is authorized, Apple Pay Later on will be readily available as an alternative when utilizing Apple Pay.

In the Wallet app, users can see, track, and handle loans, with upcoming payments revealed on a calendar and payment pointers sent out by means of the Wallet app and e-mail. Users need to establish a debit card as a loan payment technique, with charge card declined.

Apple Pay Later credit evaluation and financing is managed by Apple Funding LLC, a subsidiary of Apple. The service is based upon the Mastercard Installments program, so merchants that accept Apple Pay do not require to do anything to execute it. Apple released a series of assistance files with extra info.

Apple has actually not stated if or when the function will introduce in other nations.