A current physical silver marketing research report recommends silver to strike $30 in 2024. This appears an extremely low silver cost target thinking about a silver supply deficit, bullish nonreligious silver chart, silver relative to gold undervaluation.

Should the cost of silver not be closer to $50 offered the supply deficit?

Silver supply/demand research study

The Silver Institute launched its most current physical silver market report, about a week back.

In summary, while silver need is anticipated to stay robust, supply is anticipated to increase a little, resulting in a physical silver market lack

- Need Projection: Worldwide silver need is forecasted to reach 1.2 billion ounces in 2024, possibly the second-highest level ever taped This development is driven by more powerful commercial offtake and is anticipated to strike a brand-new yearly high, moved by increased commercial end-uses and a healing in fashion jewelry and flatware need.

- Industrial Fabrication: Silver commercial fabrication is anticipated to increase by 4 percent in 2024, reaching a record 690 million ounces. Secret chauffeurs consist of the photovoltaics and vehicle markets, with technological developments adding to greater silver offtake.

- Fashion Jewelry and Flatware Need: Precious jewelry need is anticipated to increase by 6 percent, led by development in India. Healing in fashion jewelry intake and normalization of need levels are prepared for, along with an increase in flatware fabrication by 9 percent.

- Silver Financial Investment Forecasts: Silver physical financial investment is forecasted to reduce by 6 percent, with financial development and gains in the U.S. stock exchange driving weaker financier interest. Nevertheless, a modest healing is anticipated in India and Europe.

- Supply Projection: Overall worldwide silver supply is anticipated to grow by 3 percent in 2024, reaching an eight-year high of 1.02 billion ounces, driven mainly by a healing in mine output. Silver recycling is anticipated to decrease, with lower fashion jewelry and flatware scrap supply accounting for the majority of the losses.

Market Deficit and Financial Investment Outlook: The silver market is anticipated to stay in a deficit for the 4th successive year. Market expectations of U.S. rate of interest cuts and a more powerful U.S. dollar might briefly impact silver financial investment, however silver’s favorable basics ought to motivate renewed interest once the Fed starts to cut rates.

Silver projection

What’s definitely intriguing is that the report by The Silver Institute did not discuss the word ‘silver lack’ nor did it discuss an anticipated silver cost of $30.

We raised all those points in our analysis: Silver Market Abnormality– Silver Need Outmatches Supply With A Flat Silver Rate

In an interview with CNBC, nevertheless, executive director of The Silver Institute raised the $30 silver target:

” We believe silver will have an excellent year, specifically in regards to need,” Michael DiRienzo, executive director of the Silver Institute informed CNBC. He anticipates silver rates to reach $30 per ounce, which would be a 10-year high, according to information from LSEG.

It is uncertain why this $30 silver cost target for 2024 did not appear in the report itself however was just given up an interview.

More significantly, why ‘just’ $30? Think about the following:

- Many products, if not all of them, surpassed their 2008-2012 peak.

- Silver is the only product that did not even come close to striking its 2011 peak.

- At the time of composing, the cost of silver is more than 50% listed below its 2011 highs.

- All this is taking place while there is a silver supply lack.

Any logical analysis of the silver market, based upon the information points at hand, features one and just one conclusion: HUGE UNDERVALUATION.

Silver cost chart

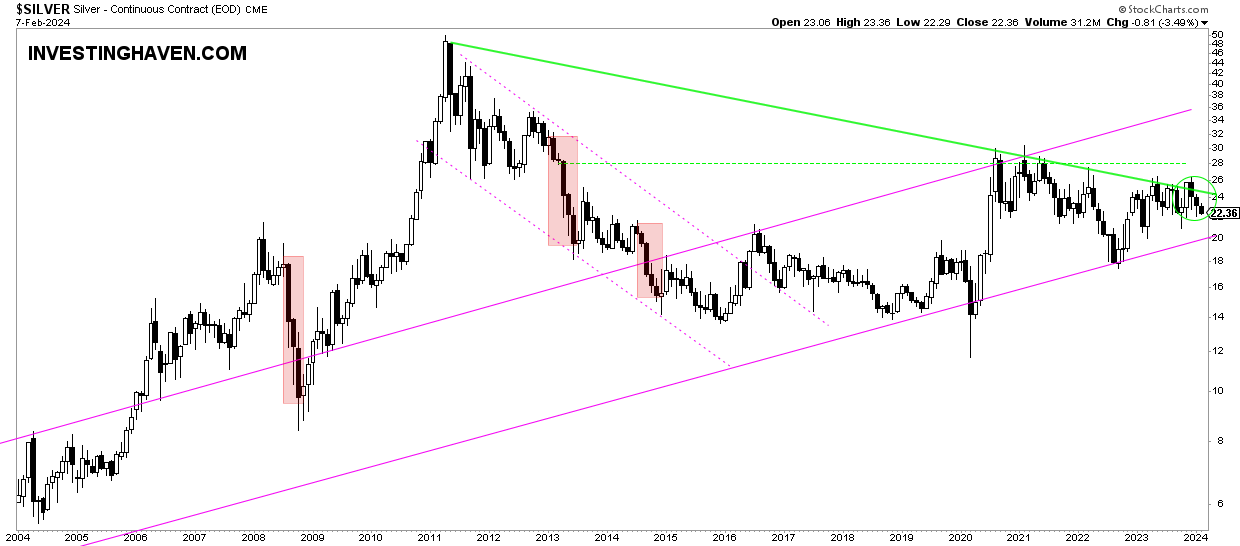

In the meantime, the silver cost chart continues to check its 13-year falling trendline.

As seen on listed below chart, the silver cost is basically flat for 3.5 years now.

More significantly, silver is dealing with an uptrend when taking a look at it from a nonreligious point of view (the last twenty years).

Whenever the 24-26 location is broken to the benefit, the cost of silver will transfer to our $34.70 target. Eventually, silver is anticipated to strike $50.

According to the chart, the silver cost target of $30 offered by The Silver Institute does not make any sense. There is no reason the cost of silver would stop increasing at $30 when previous $26.

The silver chart that truly matters

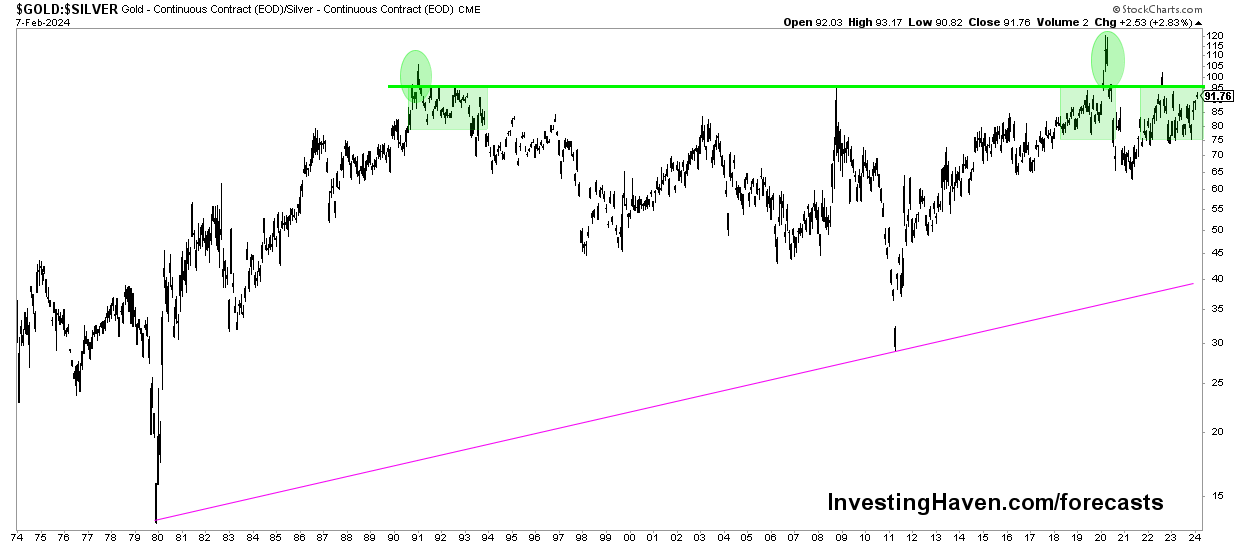

Additionally, the one chart that genuinely matters, is the gold to silver cost ratio.

Below is the gold to silver ratio over 50 years.

We have actually pointed out in the past that the nonreligious gold to silver cost ratio can serve as a ‘stretch indication.’ This ratio tends to recommend when the cost of silver is underestimated vs. misestimated compared to gold’s cost.

Have a look at the horizontal green line. At any time, in history, when the gold/silver ratio accomplished 92:1, it pressed the cost of silver much greater. Sometimes it took a couple of years, in other cases a couple of months, before silver ended up being explosive.

Silver cost momentum?

The information points do not lie: silver is a yelling buy, extensively underestimated. There is a silver supply lack, historic undervaluation of silver compared to gold, a nonreligious increasing channel on the silver cost chart.

Versus the background of extremely bullish information points, we observe absence of momentum in the silver market. Keep in mind, nevertheless, that this is partly real:

- On the one hand, the cost of silver is flat. Financiers appear extremely concentrated on trading AI & & Robotics stocks. Highflyers in AI semis, AI ops, AI tech, are capturing the attention. Many, if not all products, are just not part of this existing momentum cycle.

- On the other hand, the biggest traders net short on the silver COMEX market hold traditionally low brief positions. This is the pre-requisite for much greater rates to establish in time.

As kept in mind by Ted Butler, commercials on the silver COMEX market have the capability to avoid the silver cost from increasing. The absence of momentum, in such a way, is likewise the outcome of silver COMEX trading characteristics.

Conclusion

We conclude, based upon the information at hand, that silver is a yelling buy:

- The gold to silver cost ratio over 50 years.

- The physical silver supply deficit.

- The nonreligious silver cost chart displays a long term increasing pattern channel. Eventually, the nonreligious increasing pattern will turn the 3.5 year debt consolidation into a bull run.

The pointed out silver cost target of $30 does not make good sense to us, we see 2 bullish targets: $34.70 and $50.00. The previous ATH might not be completion point for silver.

With all this in mind, why is silver not trading at a much greater level?

The response is extremely easy: momentum is doing not have.

At this moment in time, markets choose to concentrate on AI & & Robotics stocks. Keep in mind, at too, that market rotation, presently controling market characteristics, is impressive. There is no prevalent bullish momentum, throughout all markets. Momentum, in this existing market cycle, is narrow and concentrated on just AI & & Robotics.

This truly implies that, once the existing cycle ends and a brand-new cycle begins, silver is most likely going to be amongst the possessions that will get a quote. It may go up, quickly and high, reacting to the ‘cynics’ however likewise those with conservative cost targets which just do not represent the impressive undervaluation of the silver cost.