iweta0077/iStock by means of Getty Images

Note:

I have actually covered Eneti Inc. ( NYSE: NETI) formerly, so financiers need to see this as an upgrade to my earlier short articles on the business.

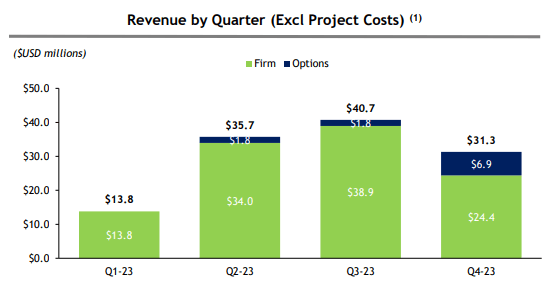

Shares of junior Wind Turbine Setup Vessel (” WTIV”) operator Eneti took a struck on Thursday after the business reported seasonally weak Q1/2023 outcomes which can be found in mostly in line with soft expectations.

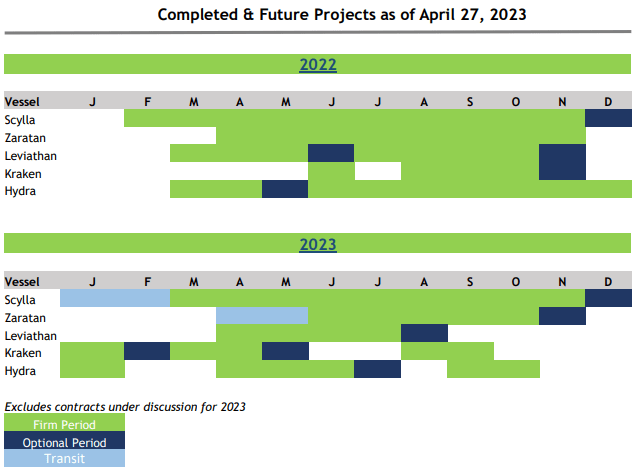

That stated, Q2 and especially Q3 need to be considerably much better with both of the business’s biggest vessels Scylla and Zaratan working once again:

Business Discussion

Regrettably, full-year profits and profits will be no place near in 2015’s levels as Scylla has actually invested the majority of Q1 in transit from Asia to the North Sea while Zaratan’s brand-new agreement offshore Taiwan will not start prior to June:

Business Discussion

Even when presuming clients working out all choices and the business achieving success in protecting extra work for its smaller sized vessels Leviathan, Kraken and Hydra, profits are most likely to be down by around 35% year-over-year.

To be reasonable, this pattern has actually been popular for a long time currently and is mainly shown in the existing expert agreement.

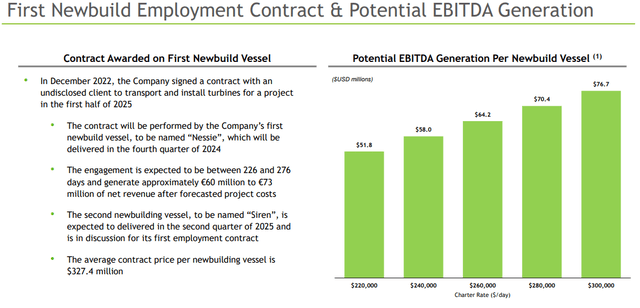

However Eneti’s story isn’t actually connected to the tradition Seajacks fleet anyhow as the business is set up to take shipment of 2 newbuild, massive WTIVs in late 2024 and early 2025, respectively, with the very first vessel Nessie anticipated to start its first agreement in the very first half of 2025:

Business Discussion

Based upon my presumptions for business expenses and financial obligation service requirements, I would anticipate the agreement to produce in between $20 million and $25 million in complimentary capital for Eneti in 2025.

To be completely sincere, I would have chosen a multi-year term for the very first newbuild, comparable to the agreement just recently protected by Danish rival Cadeler for its brand-new F-Class vessel presently under building and construction at COSCO Heavy Industries’ Qidong shipyard in China, to ensure market individuals of its capability to produce steady money streams moving forward.

That stated, on the teleconference, management indicated strong client interest in both newbuild vessels with settlements now focusing around multi-year agreements:

So there is extremely high interest in both vessels. We’re speaking with individuals about agreements throughout completion of the years. We’re speaking about multi-year, possibly multi-year upkeep agreements moving forward. Whatever is tailored towards development and sort of amazing years ahead. So we have a great deal of– we have a great deal of interest both on Nessie and Siren. And as we stated previously, we’re actually concentrated on discovering the ideal agreements for those vessels. (…)

So we have not altered our viewpoint. We’re not waiting to be the last taxi cab on the rank. We’re simply actually concentrated on discovering the ideal agreements.

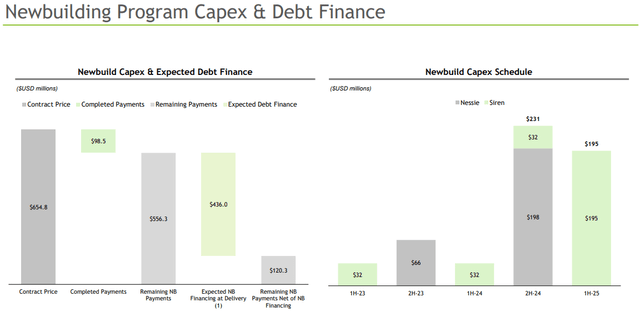

At the end of Q1, Eneti had around $117.8 million in unlimited money and staying newbuild payments of $120.3 million after representing the proposed $436 million vessel funding anticipated to be offered by Credit Agricole and Societe Generale.

Business Discussion

The business likewise has access to a presently undrawn $75 million revolving credit center which in mix with money produced from running activities need to be more than enough to cover staying newbuild capex.

Extra funds may be produced from the prospective sale of its smaller sized vessels which are thought about non-core properties:

We are now beginning to actively market for sale the NG2500s whilst we are gaining from greater day rates on these properties. Previously, we had honestly stated that we believed these were non-core properties to our fleet. Basically a year into this declaration, the marketplace has actually positively established both on the rate and usage side. And as I simply discussed, we have actually chosen to actively market the vessels for sale moving forward.

With the overseas wind turbine setup market anticipated to enhance considerably in the 2nd half of the years, I wasn’t precisely shocked by Eneti’s most current venture revealed recently (focus included by author):

Eneti Inc. (…) revealed the execution of a non-binding memorandum of comprehending showing their intent to form a joint endeavor business with Transocean Ltd that will participate in overseas wind structure setup activities ( …)

The facility and operation of the joint endeavor go through conclusive contracts which would offer (i) the conversion of a minimum of 2 Transocean vessels into drifting overseas wind structure setup platforms, (ii) competence and functional workers to be offered by both Eneti and Transocean, and (iii) the right however not the responsibility for each of Transocean and Eneti to buy the joint endeavor with extra partners The vessels, when transformed, would can bring and installing approximately 6 3,500-ton, 12-meter size monopile structures with modern security and performance.

In layperson’s terms:

Transocean would contribute a minimum of 2 cold-stacked drillships for conversion to overseas wind structure setup vessels

According to Transocean’s ( RIG) news release, the conversion would consist of the setup of a 5,200 lot crane, which would put these vessels well ahead of rival Boskalis’ Bokalift 2, likewise a transformed Transocean drillship previously called GSF Jack Ryan

Boskalis

Regrettably, both Transocean and Eneti are doing not have the funds needed to fund the equity part of a minimum of 2 multi-year crane vessel conversions. In aggregate, I would approximate conversion expenses of approximately $400 million for 2 sixth generation drillships.

As an outcome, the brand-new joint endeavor would be needed to protect a large quantity of third-party capital with Transocean and Eneti likely being entrusted minority stakes for contributing the drillships and handling the transformed crane vessels, respectively.

Throughout the questions-and responses session of the teleconference, experts lined up in droves for management to supply extra information on the proposed joint endeavor however were rebuffed for the many part.

It’s not that we desire it to be cagey is simply that we have actually begun this corporation, which we have actually been going over for a variety of months with Transocean. At this phase it’s hard for us to information more than what we stated since we are dealing with assembling a joint endeavor. And this is why we have actually begun with the MOU. As I stated, not wishing to take things away, however I would not understand what to state more than what we have actually stated currently.

Based upon declarations by the business’s COO, Eneti will be needing some sort of client dedication to proceed with the joint endeavor:

So simply from my viewpoint, the happiness of the contract is that there aren’t really any turning points. So it’s– we’re presently speaking with all of the significant customers. And based upon their action or when we get an appropriate agreement from any of these designers, then we’ll proceed from there.

Rather honestly, it’s hard to visualize prospective clients devoting to an agreement for a vessel that does not have funding in location however maybe a letter of intent or memorandum of understanding may be enough for Transocean and Eneti to proceed with their own MOU.

Anyhow, even if Transocean and Eneti choose to officially develop the proposed joint endeavor, with vessel conversion using up to 36 months, there will not be any monetary take advantage of this brand-new venture anytime quickly.

At this moment, Eneti’s future will be mainly identified by the business’s capability to protect enough work for its newbuild wind turbine setup vessels at rewarding rates.

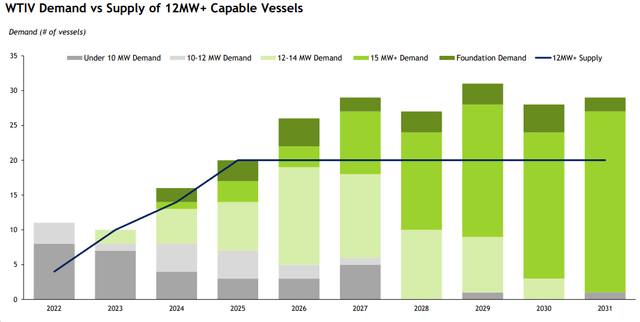

Thinking about existing expectations for vessel need to considerably surpass capable supply in the 2nd half of the years, Eneti ought to have no issues signing brand-new agreements at good terms.

Business Discussion

Bottom Line:

NETI stock sold following a seasonally weak very first quarter and expectations for full-year profits to reduce considerably from 2022 levels. In addition, management’s efficiency on the teleconference was absolutely nothing to compose house about either.

While the business’s lead to both 2023 and 2024 are most likely to stay average at best, the addition of Nessie and Siren in mix with a forecasted boost in need for overseas wind turbine setups need to lead to good complimentary capital generation from 2025 onwards.

After Thursday’s obstacle, the discount rate to approximated net property worth of $16 per share has actually increased to practically 50% which is merely too low-cost to overlook, especially when thinking about consistent long-lasting market tailwinds.

Speculative financiers with perseverance and the capability to swallow the business’s unstable operating efficiency for another number of quarters, need to think about utilizing the restored weak point in Eneti’s shares to start or contribute to existing positions.