The motion of money & & money equivalents or inflow and outflow of money is referred to as Capital. Money inflows are the deals that lead to a boost in money & & money equivalents; whereas money outflows are the deals that lead to a decrease in money & & money equivalents. For this reason, a declaration revealing circulations of money & & money equivalent throughout a defined period is referred to as a Capital Declaration. One can prepare a capital declaration if the 2 relative balance sheets of a business are offered. The deals of a capital declaration are categorised into 3 activities; specifically, Capital from Running Activities, Capital from Investing Activities, and Capital from Funding Activities. The Institute of Chartered Accountants in India has actually provided Accounting Requirement AS– 3 modified for the preparation of capital declarations. Besides, with the intro of the Business Act 2013, the preparation of a Capital Declaration is now necessary for every single kind of business other than OPC (A Single Person Business) [Section 2(40)].

Capital from 3 Various Activities

1. Format of Capital from Running Activities

* Net earnings prior to tax and amazing products is computed as:

2. Format of Capital from Investing Activities:

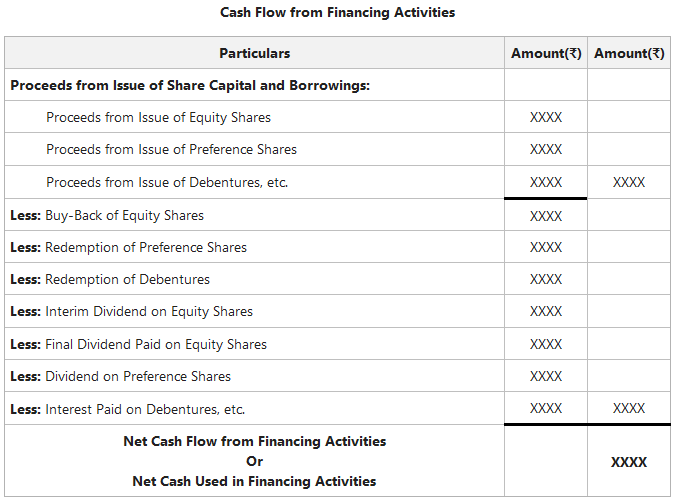

3. Format of Capital from Funding Activities: