Galeanu Mihai

Price-focused ETFs, such because the Schwab U.S. Huge-Cap Price ETF (NYSEARCA:SCHV), outperformed expansion ETFs in 2022, however this development is predicted to opposite in 2023. One of the attainable causes for the prospective underperformance of price shares might be faster-than-anticipated financial expansion, which would possibly inspire buyers to desire expansion shares. The efficiency of a few key sectors, akin to finance, healthcare, and effort, which can be hotspots for price shares, is prone to stymie the full efficiency of value-focused ETFs. I imagine the excessive beta expansion class is best situated to praise buyers having a look to capitalize in the marketplace’s attainable restoration in 2023.

Financial Traits Toughen Enlargement Over Price

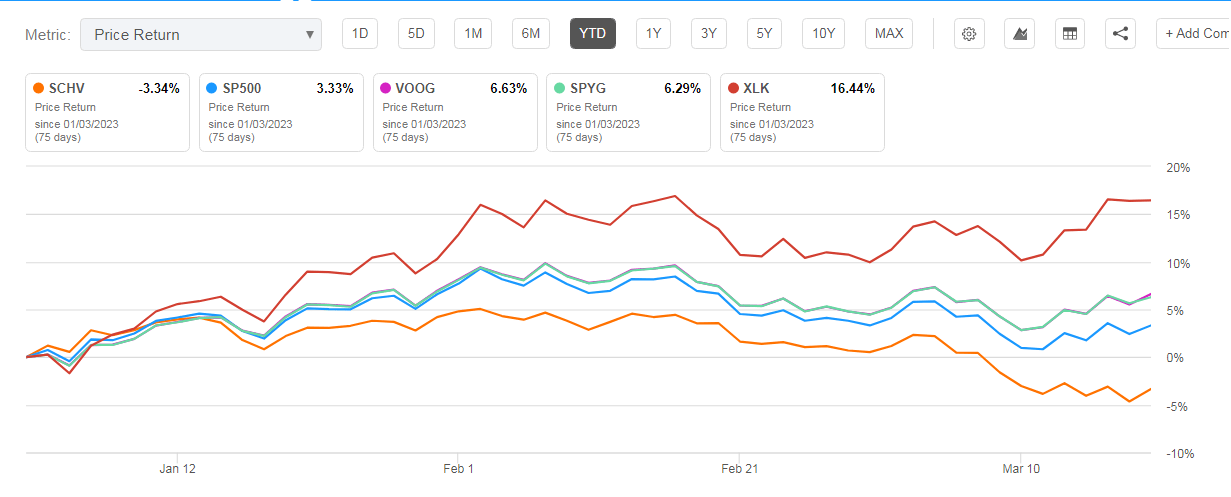

Price and Enlargement ETFs (In the hunt for Alpha)

Price shares and ETFs like SCHV began to lose flooring to expansion shares in 2023 after outperforming them in 2022 via the most important margin since the dot-com bubble. Price investments won traction in 2022, because of emerging yields, excessive inflation, and difficult financial stipulations. Buyers concept their cash can be greater safe from the wider inventory marketplace downturn via making an investment in lower-priced price shares. The tactic used to be a hit in 2022, however the marketplace dynamics greatly modified in 2023.

As proven within the chart above, expansion ETFs have outperformed a worth ETF to this point in 2023, as marketplace basics for dangerous property have advanced. The shift in investor self belief will also be attributed basically to better-than-expected financial information, slowing inflation, and expectancies for a decrease terminal degree than many had predicted. When the economic system is increasing and inflation is slowing, expansion ETFs carry out greater than their opposite numbers.

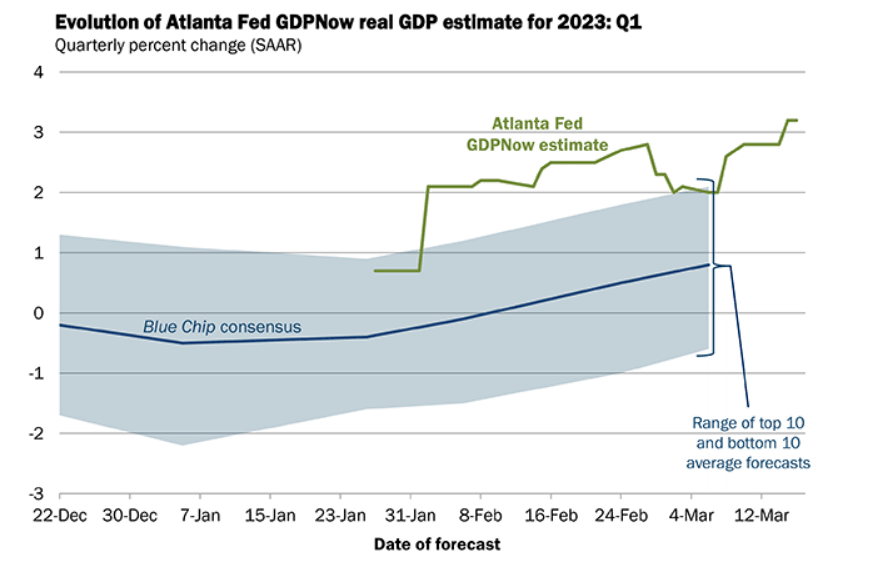

Q1 US GDP Forecast (Fed Atlanta)

Marketplace analysts and credit standing companies have progressively diminished their forecasts for an imminent recession whilst expanding their GDP projections for the US and the remainder of the sector. Over the past two months, the Atlanta Fed has raised its preliminary forecast for first-quarter GDP from not up to 1% to an up to date forecast of three.2%. Probably the most very best equipment for inspecting marketplace conduct is bank card transactions. In keeping with Mastercard SpendingPulse, retail gross sales in the US greater via 6.9% 12 months over 12 months in February and via 8.8% in January. The e-commerce trade, which may be a haven for expansion shares, greater via 13.2% in February. On a once a year foundation, in-store gross sales rose via 5.5%. Total, with sturdy retail gross sales, cast activity expansion, and the Fed nearly at its median top federal budget charge of round 5.1%, the chance of a difficult touchdown has considerably reduced and the probabilities of an financial restoration are emerging. This example bodes neatly for the full inventory marketplace and expansion shares particularly, as a result of greater stipulations now not simplest toughen the expansion class financially, but additionally inspire buyers to take dangers.

Financials, Power, and Healthcare Sectors May Obstruct SCHV’s Efficiency

Price ETFs normally come with shares from the monetary, healthcare, business, and effort sectors, while the era, shopper discretionary, and conversation services and products sectors account for almost all of the burden within the expansion class. For the reason that monetary sector accounts for roughly 18% of the SCHV’s portfolio, issues there might affect the worth class as a complete. The surprising failure of 4 US banks, in addition to the style during which Credit score Suisse bought in Europe, have sparked standard worry. Leading edge Financials Index Fund ETF (VFH), which gives broader protection of the monetary sector, has dropped about 10% because the banking disaster broke out within the ultimate two weeks.

Additionally, key metrics like bank card delinquency, web charge-offs, and provision for reserves, that have a vital affect on revenue, already began deteriorating within the fourth quarter. For example, Capital One Monetary (COF), a shopper finance corporate, reported a 34% drop in revenue for the fourth quarter, owing basically to higher-than-expected credit score provisions. Goldman Sachs (GS), one of the crucial biggest US banking giants, additionally reported a $972 million provision for credit score losses within the fourth quarter, 50% greater than analysts anticipated. All the way through an revenue name, Goldman’s CFO, Denis Coleman, mentioned that the corporate is staring at “early indicators of shopper credit score deterioration.”

Healthcare, the second-largest sector for value-focused ETFs like SCHV, will in all probability combat to develop income and revenue in 2023. In keeping with FactSet, revenue within the healthcare sector will in all probability fall via a excessive single-digit proportion in 2023 in comparison to the former 12 months. Johnson & Johnson (JNJ), SCHV’s biggest healthcare inventory, has noticed its percentage payment fall via greater than 10% because the starting of the 12 months. Different best holdings, akin to Merck & Co. (MRK) and AbbVie Inc. (ABBV), have hinted at weaker-than-expected 2023 effects. Merck expects full-year 2023 non-GAAP EPS of $6.80 to $6.95, in comparison to a consensus of $7.39. The forecast additionally signifies a vital drop from non-GAAP revenue according to percentage of $7.48 in 2022. AbbVie’s 2023 outlook requires $10.70 adjusted diluted EPS, down from $11.68 within the consensus and a lower from $13.77 in 2022.

The power sector, which had the most productive efficiency in 2022, is prone to lag in 2023 because of a pointy drop in crude oil costs. In keeping with FactSet information, revenue within the power sector are anticipated to fall 18% in 2023 from the former 12 months. The fabrics sector may be anticipated to document a 16% year-over-year revenue decline in 2023 revenue because of a drop in commodity costs.

Valuations

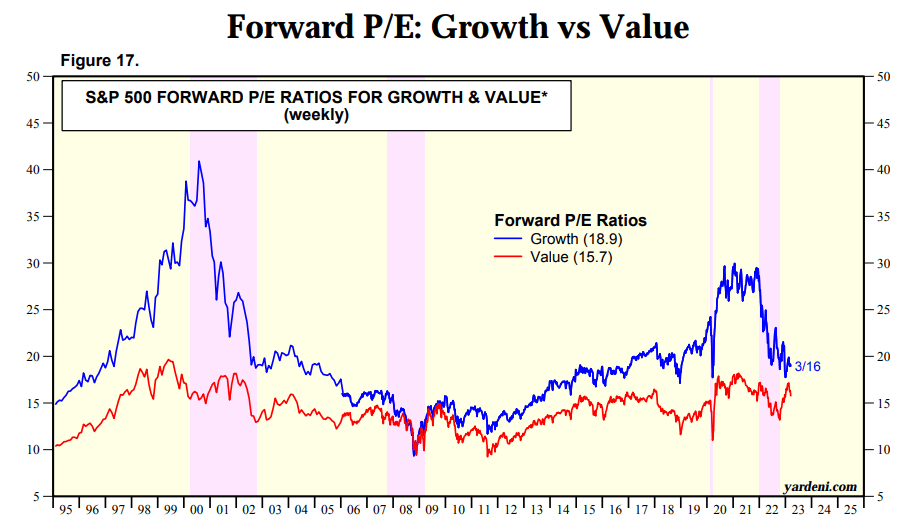

Enlargement Vs Price Ahead PE (Yardeni.com)

When in comparison to expansion firms, price firms normally have low price-to-book and price-to-earnings ratios. As proven within the chart above, the worth class’s ahead PE ratio greater sharply on account of percentage payment expansion and deteriorating revenue expectancies, which doesn’t bode neatly for long run payment efficiency. The price class is recently buying and selling above its five- and ten-year averages and on the subject of its all-time excessive set in 2021. Alternatively, the steep payment drop in 2022 made the expansion class seem interesting. It’s recently buying and selling a lot not up to its earlier highs, in addition to not up to its five- to ten-year averages. Total, it sort of feels that expansion shares have extra space for upside than price shares which are already buying and selling on the subject of their earlier highs.

Choice Choices

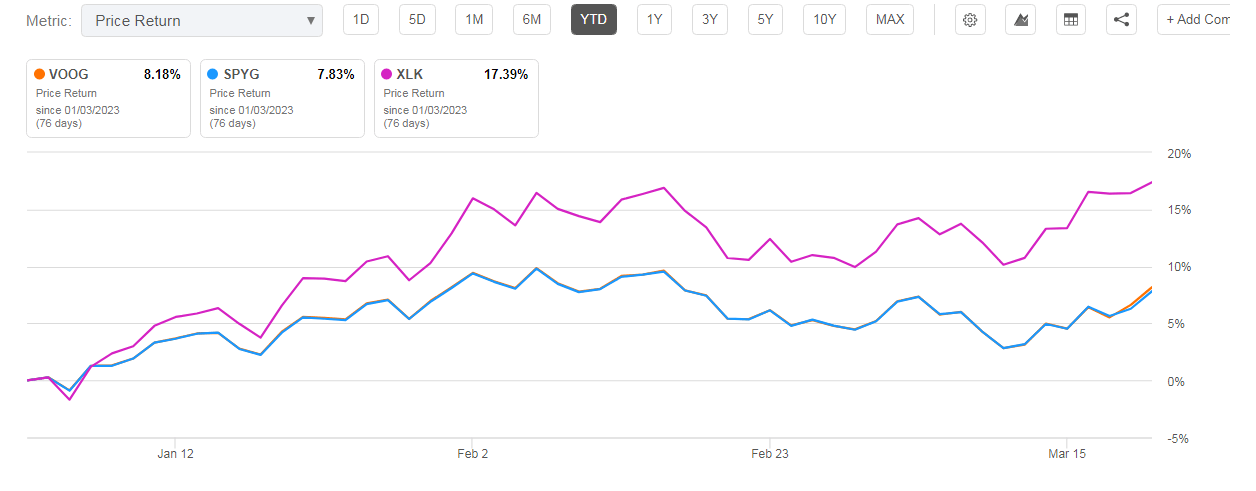

Enlargement ETFs Yr to Date Efficiency (In the hunt for Alpha)

As I be expecting price ETFs like SCHV to underperform in comparison to expansion ETFs, buyers can pursue a number of interesting expansion choices to capitalize on ultimate 12 months’s selloff and attainable restoration in 2023. For buyers with a high-risk tolerance and a need for prime returns, the Generation Make a selection Sector (XLK), which gives extra complete protection of the era sector, is usually a just right choice. The percentage payment of XLK has greater via nearly 17% to this point in 2023 on account of stronger-than-expected monetary effects and financial tendencies. The ETF gained a powerful purchase advice from In the hunt for Alpha’s quantitative machine, which gave it a quant ranking of over 4.90. You’ll learn my article “XLK Nonetheless Gives A Purchasing Alternative” for a extra detailed rationalization of why XLK and the tech trade are anticipated to accomplish neatly in 2023.

Each the SPDR Portfolio S&P 500 Enlargement ETF (SPYG) and the Leading edge S&P 500 Enlargement ETF (VOOG) be offering broader protection of the expansion class and come with securities from all 11 S&P 500 sectors, with a excessive emphasis on tech, shopper discretionary, and conversation services and products. Each ETFs earned purchase scores from In the hunt for Alpha’s quant machine on account of cast grades on momentum and liquidity components. You’ll additionally learn intimately about those two ETFs via clicking right here and right here.

In Conclusion

Schwab U.S. Huge-Cap Price ETF earned a hang ranking from the In the hunt for Alpha quant machine because of a low ranking at the momentum issue. SCHV has a narrow probability of outperforming the wider marketplace index in 2023 since the monetary sector goes via tough occasions. The efficiency of the worth class as a complete can be impacted via the pointy decline in revenue forecasts for the power and fabrics sectors. Against this, sturdy financial expansion tendencies would spice up buyers’ self belief in excessive beta expansion shares, prompting them to shop for them at a lot decrease costs with the intention to make the most of a possible restoration in 2023.