Khanchit Khirisutchalual

Pricey Fellow Shareholders,

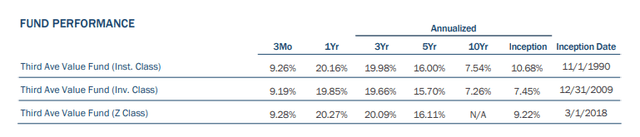

For the 3 months ended December 31st, 2023, the 3rd Road Worth Fund (MUTF:TAVFX)(the âFundâ) returned 9.26%, as in comparison to the MSCI International Index1, which returned 11.53%. For additional comparability, the MSCI International Worth Index2 returned 9.48% right through the quarter. This quarterâs efficiency brings the Fundâs year-to-date go back to twenty.16%, which trailed the 24.42% efficiency of the MSCI International Index however exceeded the 12.41% efficiency of the MSCI International Worth Index.

The Excellent, The Dangerous & The Unpleasant

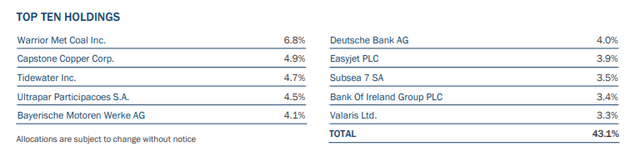

All through 2023, the combo of positions contributing to Fund efficiency advanced fairly from prior years. A number of long-held herbal resource-related positions, comparable to Warrior Met Coal (HCC), Tidewater (TDW), and Capstone Copper (OTCPK:CSCCF), endured to offer necessary certain contributions to Fund efficiency, as did a number of long-held continental Ecu holdings, comparable to BMW (OTCPK:BMWYY), Buzzi (OTCPK:BZZUF), and Deutsche Financial institution (DB). Then again, a number of holdings bought extra just lately right through 2022, additionally made vital certain contributions to Fund efficiency right through 2023. Particularly, easyJet (OTCQX:EJTTF), a U.Ok.-based cheap recreational airline, and Ultrapar (UGP), a Brazilian retail and business gasoline distribution and garage trade, each supplied necessary efficiency contributions right through the 12 months. In the meantime, Jap fuel drift keep watch over and dimension corporate HORIBA (OTCPK:HRIBF), an funding we initiated only some quarters in the past, additionally carried out really well all the way through the second one 1/2 of the 12 months offering a significant contribution. Senior analysis analyst, Ryan Korby, merits the reward for identity and research of the chance within the stocks of HORIBA.

Then again, the opposite aspect of the ledger, the place the deficient performers are living, used to be ruled via our funding in S4 Capital (OTCPK:SCPPF), a virtual promoting and media corporate. Our funding in S4 started in 2022 as a contrarian alternative in an organization with a number of self-inflicted, however resolvable, wounds. It has since advanced into an funding in an organization dealing with the primary vital virtual promoting downturn for the reason that corporateâs founding in 2018. The corporate, which stays within the strategy of restoring the fullness of its recognition with traders, whilst now concurrently dealing with trade headwinds, has reached valuations we view as confusingly low. We don’t view the corporate to be completely impaired and, frankly talking, the severity of cyclical headwinds dealing with the virtual promoting trade lately are in reality somewhat delicate, compared to many different cyclical industries wherein we now have enjoy. We also are typically proud of controlâs seriousness of function in remedying earlier operational shortcomings. Our response has been to proceed so as to add to our holdings of S4. We’d additionally be aware that, as contrarian cost traders, we’re familiar with making an investment in corporations, industries, and nations with darkish clouds soaring above them on the time of funding, simplest to look the ones clouds darken additional ahead of after all dissipating. In truth, that trend describes numerous our maximum a hit long-term investments. We stay constructive that S4 might someday be described in any such approach.

Charges, Ruses & Regime Adjustments â Revisited

In early 2023, our crew printed a whitepaper titled Charges, Ruses & Regime Adjustments. It used to be, in essence, our resolution to the query of whether or not cost methods wanted upper rates of interest to outperform.

We argued strongly in opposition to the traditional knowledge of the day – that low rates of interest choose progress making an investment methods – and located little, if any, enhance for any such perception from many years of economic marketplace historical past. We argued that the observable correlation between low or falling rates of interest and progress making an investment supremacy used to be a up to date building and one with out glaring ancient precedent. We additionally argued there used to be most likely a component of self-fulfilling prophecy at paintings within the perpetuation of that correlation, a phenomenon that happens continuously in monetary markets. For all of those causes and several other others, we concluded that one must no longer depend closely at the endurance of any such correlation. Finally, the primary rule in statistics isn’t to mistake correlation for causality and monetary markets be offering an extended historical past of correlations breaking down at unpredictable occasions in unanticipated techniques.

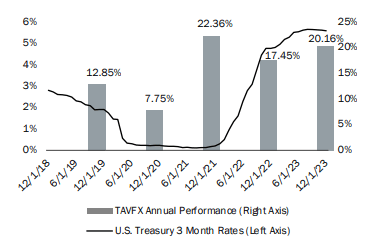

As early 2023 improved, U.S. rates of interest endured to upward thrust, and but the unabashedly growth-oriented NASDAQ 100 Index3 finished its most powerful 12 months of efficiency since 1999 – the height 12 months in one among historical pastâs most famed tech bubbles – showing massive outperformance relative to broader indices. Whilst that can appear encouraging to a few, the prevalence of rampant progress inventory supremacy, in live performance with emerging rates of interest, weakens the âlow charges are excellent for progressâ narrative. The dying of that correlation, and erroneously perceived causal dating, would go away U.S. fairness markets replete with many very pricey shares with no nice supporting tale, in our view. Certainly, from a top-down quantitative standpoint, there are some early indicators that the correlation between low charges and progress methods noticed in recent times did start to weaken observably in 2023. Over longer ancient sessions, there’s scant proof of any correlation by any means, so a shrinking correlation appears, to us, like not anything greater than a possible normalization or a vanishing anomaly. Naturally, we now have fielded many questions on the connection between rates of interest and price making an investment as a method in recent times. All of that attention and investigation led us to the belief that there isnât an glaring constant or predictable dating through the years. Itâs merely no longer a attention we’d counsel one use in figuring out an fairness allocation. Finally, and maximum germane to what we in reality do as a crew of basic cost traders, right through the previous couple of years, in a unexpectedly converting rate of interest atmosphere, we now have noticed no discernable dating by any means between the Fundâs absolute returns and U.S. rates of interest, which declined for 3 of the 5 years after which rose sharply for 2.

TAVFX ANNUAL PERFORMANCE VS 3-MONTH SOFR*

*Secured In a single day Financing Price

In conclusion, with the advantage of a couple of extra information issues right through a unexpectedly moving rate of interest atmosphere, we land precisely the place we did once we printed Charges, Ruses & Regime Adjustments nearly 12 months in the past; although you’re ready to correctly are expecting the long run degree of rates of interest – and only a few folks appear to be in that place – it does no longer essentially confer any skill by any means to are expecting which form of fairness making an investment taste would possibly be successful over that point horizon. Through the years, correlations fortify, weaken, and opposite in unpredictable techniques. Sound and time-tested funding methods must be appreciated and given time to accomplish fairly than traded according to macroeconomic forecasts. We proceed to consider that there are way more dependable issues with which to fear ourselves, comparable to the cost we pay for a safety relative to the elemental financial returns presented via the trade that issued the safety.

Banks, Charges & Worth

An excessive amount of of a excellent factor will also be superb.

– Mae West

It appears, Ms. West by no means ran a financial institution. For lots of monetary companies, rates of interest are so much like medication in that the right kind dosage will also be salubrious, whilst an excessive amount of of the similar medication can end up deadly. In a similar fashion, the best way rates of interest affect the well being of industries and firms can shift meaningfully through the years. There are few higher examples of this concept than the U.S. regional financial institution sector and Comerica, specifically.

Comerica (CMA), a long-time Fund protecting, is an odd superregional financial institution because of the level of company publicity in its mortgage e-book, as in comparison to many different U.S. regional banks with a lot higher exposures to residential mortgages. As a result of a lot of this company lending is completed on a floating-rate foundation, Comericaâs asset yields reply surprisingly unexpectedly to rate of interest actions. As rates of interest rose over the previous couple of years, Comericaâs asset yields did certainly upward thrust sharply as nicely, an excessively certain building. On this approach, Comerica, in conjunction with many U.S. regional banks, had been rightly perceived as beneficiaries of U.S. rates of interest emerging from traditionally low ranges. One thing equivalent will also be mentioned of our Ecu banking investments the place Financial institution of Eire and Deutsche Financial institution have additionally been aided via emerging Ecu charges. Then again, upper charges had been useful for many U.S. regional banks, till they werenât. By means of early 2023, charges had risen excessive sufficient, and unexpectedly sufficient, to show a large number of period chance (the chance related to the worth of longer-dated bonds bearing upper sensitivity to rate of interest actions than shorter-dated bonds) provide inside the massive fixed-income portfolios comprising massive parts of many regional financial institution stability sheets. In the long run, accelerating deposit withdrawals at a couple of banks led to high-profile manifestations of this chance, resulting in a few financial institution insolvencies, heightened worry, extra withdrawals, and a spiral which needed to be arrested via the U.S. Federal Reserve, Treasury and FDIC. U.S. regional financial institution shares had been punished significantly right through the primary 1/2 of the 12 months.

Thru this still-evolving U.S. banking panorama, we will see a real-life instance of ways an tradeâs dating with a very important basic issue, comparable to rates of interest, can shift or even opposite through the years. Upper rates of interest had been at one level noticed as a panacea for underearning banks and just a twinkling of an eye later had been noticed as probably deadly for a similar crew of banks. So as to add but another layer of complexity for attention, as a result of Ecu banks weren’t flooded with deposits right through COVID to the similar extent as their U.S. regional opposite numbers, and as a result of the best way mark-to-market actions of financial institution property are handled in Europe, Ecu banks have, so far, typically skilled the advantage of upper charges with out the trauma that U.S. regional banks skilled afterwards. As a result of even a unmarried financial institution could have a unexpectedly evolving dating with rates of interest, and since more than a few banks in more than a few jurisdictions have idiosyncratic facets that govern their relationships with rates of interest, it is vitally unhealthy to think a hard and fast and lasting generalized dating, comparable to a long-lasting certain correlation between the extent of rates of interest and financial institution efficiency.

Within the warmth of the Spring 2023 panic, we disclosed that we had added to our holdings of Comerica and mentioned our pondering associated with regional banks extra typically. Since that point, deposit flight has widely come beneath keep watch over and the shares of many U.S. regional banks, Comerica incorporated, have staged sturdy recoveries, albeit simplest in part so. One very legitimate reason for the partial nature of the restoration is that there aren’t any unfastened lunches in banking. It’s certainly horny for banks to lend at upper charges, however upper borrowing prices lift the debt carrier burden on debtors, make refinancing loans at adulthood tougher, and might also building up the chance of macroeconomic slowdown, all of which lift the chance of upper non-performing loans, defaults, and mortgage losses. So, whilst it is going to seem that the majority of Comericaâs loans, in addition to the ones of the leveraged mortgage marketplace and the personal credit score marketplace, could also be secure from period chance via their floating-rate nature, they’re steadily simply buying and selling period chance for credit score chance. In different phrases, a leveraged mortgage would possibly produce upper revenue because the mortgageâs reference price resets upper however, within the procedure, what used to be at first a BBB credit score chance can have changed into a CCC credit score chance because the borrowerâs hobby burden climbs and talent to refinance at adulthood turns into extra tenuous. No unfastened lunches. Apparently, as the expectancy of stabilizing, and sooner or later declining, U.S. rates of interest took hang in the second one 1/2 of 2023, U.S. regional financial institution shares did degree an excessively sturdy restoration. For the report, in spite of a deeply difficult twelve-month length, Comerica ended 2023 having made a favorable contribution to Fund efficiency, basically because of our Spring purchases and next second-half positive factors.

In the end, it’s undeniable to look that the affect of rates of interest at the U.S. regional financial institution trade has advanced dramatically in a brief time period. It is extremely believable that, from this level, the U.S. regional financial institution trade is usually a vital beneficiary of fairly decrease rates of interest. From a basic standpoint, decrease U.S. hobby would most likely alleviate incentives for financial institution deposits to hunt upper yields in other places, cut back present mark-to-market losses on bond portfolios hung on financial institution stability sheets, and cut back one of the most issues round emerging credit score losses and macroeconomic slowdown. It’s going to no longer be misplaced on many readers that banks, and financials extra widely, include a disproportionately massive weight inside many value-oriented indices. It’s possible that decrease rates of interest might, sooner or later, grow to be a tailwind for cost methods widely, which might constitute the replicate symbol of the present knowledge in recent times.

A Worth Vignette

On an constructive be aware, however our previous derisory remark in regards to the U.S. fairness marketplace being âreplete with many very pricey shares,â it seems that to us that a large amount of horny cost stays inside international fairness markets lately. The Fund, for its section, carried a weighted reasonable value to revenue4 ratio of roughly 8.2x, as of year-end. Importantly, it’s our view that we’ve got been in a position to place the Fund with this degree of cheapness with out stress-free different essential standards, comparable to stability sheet power, liquidity, or chance of secular decline. Our skill to perform this feat has been enabled, partially, via a broad-based progress and generation inventory obsession in recent times, which has left some very horny companies orphaned and affordable. As we now have mentioned advert nauseum in recent times, no longer simplest have reasonable shares no longer skilled the valuation a couple of enlargement loved via pricey shares, and via U.S. fairness indices via extension, however many reasonable shares changed into even less expensive in recent times. We provide a couple of excessive issues relating to our funding in BMW AG, definitely a number of the maximum well known corporations held within the Fund lately, as representation of horny, well-financed cost:

All through the 5 years thru 12 months finish 2023, BMW AG not unusual inventory produced an annualized general shareholder go back of 12.8% in U.S. buck phrases (13.6% in EUR phrases). Whilst it doesnât rival the go back of Magnificent Seven constituent Tesla, it does rival the go back of the MSCI International Index right through an excellent run of index returns. In the meantime, during the last 30 years, BMW AG stocks have produced a complete shareholder go back of 10.6% in USD phrases, considerably upper than the MSCI International Index go back. In different phrases, it’s been a beautiful excellent trade, generating lovely horny returns over an extended time period. In more moderen sessions, returns had been generated via each inventory value appreciation and critical dividend bills. At this time, the inventory provides a dividend yield5 of roughly 8.4% in step with 12 months, according to the 2023 dividend distribution. Then again, what is especially fascinating in regards to the ultimate 5 years is that the horny annualized returns had been achieved despite the headwind of the up to now discussed valuation a couple of decline. At 12 months finish 2018, BMW used to be buying and selling at 6.5x analystsâ estimates of ahead revenue, (in keeping with CapIQ), however via the tip of 2023, that very low valuation a couple of had fallen even decrease to six.1x ahead revenue. Each multiples are considerably under the valuation multiples assigned to the corporate in previous sessions. This enjoy is a microcosm of the modest derating of inexpensive shares we proceed to focus on as having came about within the background of markedly expanding valuations of large international fairness indices. In linked numbers, BMW not unusual inventory is lately buying and selling at kind of 73% of e-book cost6 whilst having generated a 12.7% go back on fairness over the trailing three hundred and sixty five days. As for the monetary place, BMW is sort of surely extraordinarily well-financed with nicely greater than EUR 20 billion of extra money, amounting to about one-third of its marketplace cap. In 2022, BMW authorized a EUR 2 billion buyback, which used to be adopted up with some other EUR 2 billion buyback 12 months later. And, on account of the very spectacular ranges of operational money drift7, the corporateâs money balances have simplest endured to develop, even whilst making an investment for an electrical automobile transition, making multibillion-euro dividend bills, and executing multi-billion euro buybacks.

In the end, what in regards to the secular decline chance on account of the electrical automobile revolution? Finally, we had been informed that Tesla (TSLA) goes to consume the sector, a mantra which now turns out short of revision to incorporate BYD (OTCPK:BYDDF). Within the hobby of brevity, we provide just a few issues. Now we have believed for a while that BMW, as a particularly well-financed engineering powerhouse, wielding one of the vital globalâs Most worthy manufacturers, used to be prone to stay extremely aggressive, impartial of the tempo of electrical automobile adoption. Then again, we now have additionally believed that the tempo and supreme degree of adoption stay extremely unsure. Contemporary information on electrical automobile gross sales volumes in each the U.S. and Europe, in addition to rising broker stock ranges, counsel slowing gross sales progress and excessive dependency upon massive acquire subsidies. Whether or not governments proceed to closely subsidize electrical automobile purchases and whether or not customers urge for food for terribly pricey automobiles persists undented in the next rate of interest atmosphere stays unsure. All of that mentioned, it stays somewhat sudden to us how little consideration is given to the truth that BMW, in addition to Mercedes-Benz (OTCPK:MBGAF) for that subject, have each been rising battery electrical automobile volumes materially sooner than Tesla in fresh quarters. With all of that considered, it turns into very onerous to grasp a valuation a couple of of 6.1x revenue. We promised brevity so we can save the research of what a BMW valuation looks as if when one comprises the worth of its extra money and a theoretical stand-alone cost for its possession of Rolls-Royce (OTCPK:RYCEY).

Quarterly Job

All through the quarter finishing December 31st, 2023, the Fund initiated a place in Bolsa Mexicana de Valores, S.A.B. de C.V. (âBolsa Mexicanaâ) (OTCPK:BOMXF) and exited positions in Hutchison Port Holdings (OTCPK:HCTPF) and Ashmore Crew % (OTCPK:AJMPF). The Fund additionally exited holdings of SPDR S&P 500 ETF Believe put choices, that have been hired periodically in recent times as a result of they have got, once in a while, been surprisingly affordable to buy and have a tendency to act as one thing of an insurance plans in opposition to U.S. fairness marketplace declines, a chance we view as increased of overdue. The Fundâs exits from Hutchison Port Holdings and Ashmore Crew had been, in each instances, a reaction to a loss of development having been made in opposition to more than a few facets of our funding theses.

Bolsa Mexicana is an alternate operator, maximum significantly of the Mexican Inventory Trade and Mexican Derivatives Trade, whilst additionally offering linked custody, clearing, agreement, and information products and services. A lot of Bolsa Mexicanaâs fee-generating actions have stagnated in sympathy with Mexican capital marketplace process, making a low bar for stepped forward working efficiency. Only a few fairness listings have taken position in Mexico over the last a number of years and the ratio of home marketplace cap to GDP, in addition to buying and selling process, lags that of many peer nations. Then again, a number of federal legislative efforts are lately advancing to give a boost to the good looks of Mexican capital markets to issuers and traders, and enhance preliminary public choices, debt issuance, and buying and selling process.

Whilst its buying and selling and clearing companies could also be front-of-mind when any person thinks of Bolsa Mexicana, two different spaces even have vital affect at the corporateâs peak and backside strains. In truth, the one biggest portion of corporate earnings derives from its operation of the central safety depository (âCSDâ). Thru this line of industrial, Bolsa Mexicana is via some distance the most important supplier of securities custody products and services in Mexico, a extremely winning trade with working margins more than 70% over the last a number of years and property beneath custody proceeding to march upper over the last decade. Along with the CSD, Bolsa Mexicana additionally has a fast-growing data products and services unit which produces indices thru an alliance with Same old & Deficientâs, in addition to different marketplace information and chance control merchandise.

The corporate maintains an excessively sturdy web money stability sheet and the character of the trade involves fairly low capital expenditure and regulatory capital necessities. Bolsa Mexicanaâs sturdy monetary place has enabled the corporate to go back a excessive share of its working money drift to shareholders within the type of dividends and, in recent times, percentage repurchases. Bolsa Mexicana additionally seems affordable in an absolute sense in addition to undervalued relative to publicly-traded friends and ancient merger and acquisition transactions within the trade.

Thanks in your self assurance and believe. We stay up for writing once more subsequent quarter. In the meanwhile, please don’t hesitate to touch us with questions or feedback at [email protected].

Sincerely,

Matthew Effective

IMPORTANT INFORMATION

This newsletter does no longer represent an be offering or solicitation of any transaction in any securities. Any advice contained herein is probably not appropriate for all traders. Data contained on this newsletter has been got from assets we consider to be dependable, however can’t be assured. The tips on this portfolio supervisor letter represents the reviews of the portfolio supervisor(s) and isn’t meant to be a forecast of long term occasions, a ensure of long term effects or funding recommendation. Perspectives expressed are the ones of the portfolio supervisor(s) and might range from the ones of alternative portfolio managers or of the company as a complete. Additionally, please be aware that any dialogue of the Fundâs holdings, the Fundâs efficiency, and the portfolio supervisor(s) perspectives are as of March 31, 2023 (except for as another way said), and are topic to modify with out realize. Positive data contained on this letter constitutes âforward-looking statements,â which will also be known by means of forward-looking terminology comparable to âmight,â âwill,â âmust,â âbe expecting,â âwatch for,â âchallenge,â âestimate,â âintend,â âproceedâ or âconsider,â or the negatives thereof (comparable to âwon’t,â âmust no longer,â âdon’t seem to be anticipated to,â and so on.) or different diversifications thereon or related terminology. Because of more than a few dangers and uncertainties, precise occasions or effects or the true efficiency of any fund might range materially from the ones mirrored or pondered in such a forward-looking remark. Present efficiency effects could also be decrease or upper than efficiency numbers quoted in positive letters to shareholders.

Date of first use of portfolio supervisor observation: January 19, 2024

1The MSCI International Index is an unmonitored, unfastened float-adjusted marketplace capitalization weighted index this is designed to measure the fairness marketplace efficiency of 23 of the sectorâs maximum advanced markets. Supply: MSCI.

2MSCI International Worth: The MSCI International Worth Index captures massive and mid-cap securities showing total cost taste traits throughout 23 Advanced Markets (DM) nations. The price funding taste traits for index building are outlined the usage of 3 variables: e-book cost to value, 12-month ahead revenue to value and dividend yield. Supply: MSCI

3The Nasdaq 100 Index is a choice of the 100 biggest, maximum actively traded corporations indexed at the Nasdaq inventory alternate. Supply: Nasdaq

4The cost-to-earnings ratio is the ratio for valuing an organization that measures its present percentage value relative to its revenue in step with percentage (EPS). The cost-to-earnings ratio may be from time to time referred to as the cost a couple of or the revenue a couple of. Supply: Investopedia

5The dividend yield, expressed as a share, is a monetary ratio (dividend/value) that displays how a lot an organization will pay out in dividends each and every 12 months relative to its inventory value. Supply: Investopedia

6E book cost is the sum of the quantities of all of the line pieces within the shareholders’ fairness segment on an organization’s stability sheet. Supply: Investopedia

7Money Glide: Money drift is the online money and money equivalents transferred out and in of an organization. Money gained represents inflows, whilst cash spent represents outflows.

Previous efficiency is not any ensure of long term effects; returns come with reinvestment of all distributions. The above represents previous efficiency and present efficiency could also be decrease or upper than efficiency quoted above. Funding go back and major cost range in order that an investorâs stocks, when redeemed, could also be value kind of than the unique price. For the newest month-end efficiency, please consult with the Fundâs web site at www.thirdave.com. The gross expense ratio for the Fundâs Institutional, Investor and Z percentage categories is 1.22%, 1.47% and 1.16%, respectively, as of March 1, 2023.

Dangers that would negatively affect returns come with: fluctuations in currencies as opposed to america buck, political/social/financial instability in international nations the place the Fund invests loss of diversification, and opposed common marketplace prerequisites.

The fund’s funding targets, dangers, fees, and bills should be regarded as in moderation ahead of making an investment. The prospectus incorporates this and different necessary details about the funding corporate, and it can be got via calling 800-443-1021 or visiting www.thirdave.com. Learn it in moderation ahead of making an investment.

Distributor of 3rd Road Finances: Foreside Fund Products and services, LLC.

Present efficiency effects could also be decrease or upper than efficiency numbers quoted in positive letters to shareholders.

3rd Road provides a couple of funding answers with distinctive exposures and go back profiles. Our core methods are lately to be had thru ’40Act mutual price range and custom designed accounts. If you need additional data, please touch a Dating Supervisor.

Editor’s Notice: The abstract bullets for this text had been selected via In the hunt for Alpha editors.

Editor’s Notice: This text discusses a number of securities that don’t industry on a big U.S. alternate. Please pay attention to the dangers related to those shares.