pidjoe

Financial Investment Thesis

NextEra Energy ( NYSE: NEE) is among the biggest energies service providers in the United States. The company’s energy, “Florida Power & & Light “is the biggest in the country with the company likewise establishing a worldclass renewable resource company.

An appealing market position and excellent relationship with regulators in Florida permit FPL to function as a monopoly setting a rate for energies which ensures an adequate return on capital for the company.

Exceptional company economics permit these rates to still be lower than the nationwide typical showing the fiscally effective way in which FPL is run.

In general, I like the business, I like its management group and I discover the present evaluation to provide around a 12% discount rate in shares relative to their intrinsic worth.

I for that reason rate NextEra a Strong Buy and have actually started a position in the energy worth 8% of my overall portfolio worth since present time.

Business Background

NextEra Energy|Financier Relations

NextEra Energy is among my preferred regulated energies in the United States with the company having an enormous existence in Florida.

The company‘s controlled energy “Florida Power & & Light “is the biggest rate-regulated energy in the state with the company dispersing power to almost 6 million consumer accounts and owns around 32 gigawatts of electrical energy generation.

NextEra likewise has a renewable resource sector, “NextEra Energy Resources” creates and offers power throughout the U.S. and Canada with about 25 gigawatts of generation capability attained through a mix of gas, nuclear, solar and wind.

While energies have actually long been avoided for their capital extensive and fairly sluggish income development, I basically think these business are fantastic steady long-lasting financial investments thanks to their legal capability to set rates that lead to enough ROICs and ROAs.

John Ketchum presently heads NextEra as chairman, president and CEO. Ketchum continues to put consumer worth at the leading edge of NextEra’s company goals with a strong belief that a shift towards more eco-friendly energy generation services will assist NextEra shift into a carbon-neutral economy in the future.

Ketchum is likewise an eager supporter for monetary discipline, a strong balance sheet and constant development and enhancement in order to make sure NextEra stays competitive. The concentrate on monetary discipline and a strong balance sheet in specific is exceptional to see in my viewpoint as this is where numerous energies can lose their competitive benefits particularly over long period of time durations.

Financial Moat– In Depth Analysis

I think that NextEra take pleasure in a robust and broad financial moat thanks to the nearly monopolistic control the company enjoys in Florida and thanks to basic qualities that form energy policy in the United States.

NextEra’s Florida Power & & Light energy has special rights to charge their clients enough rates for electrical energy and power so regarding make what is considered a “reasonable” return on the capital they invest to run their energy network.

The state of Florida has fairly favorable regulative environment for Florida Power & & Light with the 2 working carefully together to set the rates the energy might charge for their service.

While the capital requirements are rather big for energies, I think that this basic policy and NextEra’s nearly special arrangement of power in Florida allows the company to produce steady returns and eventually assists ensure the success of the company’s core operations.

I think that NextEra’s exceptional expense control and concentrate on a strong balance sheet have actually enabled the company to charge below-average retail rates for their service which eventually assists provide the business’s monopolistic company in a much better light to currently encouraging regulators.

Florida Power & & Light is likewise America’s biggest energy which highlights simply how effectively NextEra has actually handled to grow this energy supplier in the sunlight state.

NextEra likewise runs the abovementioned renewable resource company which I think contributes another degree of moatiness to the company’s total company operations. The company has actually put a considerable concentrate on their wind power generation centers with a long-lasting goal to repower around 740MW through wind centers by 2026.

The company intends to accomplish these objectives by selling tradition pipeline operations and concentrating on high-yielding development chances in the renewables classifications. This proactive technique to decarbonizing their energy generation services has actually led to NextEra getting some extremely rewarding sustainable power websites.

On an international scale NextEra Energy Resources is among the world’s biggest wind energy manufacturers running more than 16,000 MW of emissions-free wind energy. The company likewise runs a leading portfolio of ingenious solar power generation plants consisting of a mix of photovoltaic and solar-gas hybrid websites.

Florida itself naturally provides for fantastic solar energy generation chances with NextEra making the most of this natural tendency for sunshine by setting up more than 30 million brand-new panels in Florida by 2030.

I think that NextEra currently has an infrastructural benefit in the renewable resource sector which eventually need to permit the company to produce excess returns on their currently invested capital compared to energy companies only simply entering into the renewables sector.

In general, I think NextEra’s exceptional Florida Power & & Light energy integrated with their fantastic portfolio of worldclass renewable resource generation services need to permit the company to produce fantastic returns on their invested capital while concurrently running an excellent quality company.

I should likewise include that I actually like the management group at NextEra and think they are a few of the very best experts in the energies sector. Their comprehensive concentrate on strong principles, liquidity and continual development are an uncommon mix of conservative financial preparation and continuous forward believing.

Financial Scenario

NextEra has actually been for the much better part of a years an extremely successful and well-run company from a functional efficiency viewpoint.

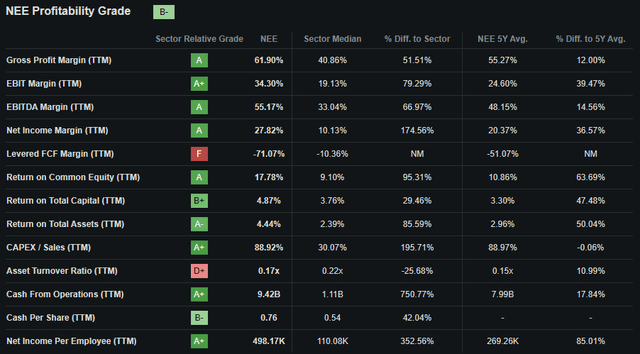

NextEra’s 5Y (FY22-FY18) typical ROA, ROE and ROIC have actually been 3.16%, 11.02% and 6.00% respectively. These returns are rather favorable undoubtedly with the company tangibly surpassing inflation with their returns on both equity and invested capital.

It needs to likewise be thought about from an outright viewpoint that a NextEra’s ROE surpasses that of a federal government bond yielding state 2-4% by a considerable margin which eventually highlights simply how healthy of an organization NextEra is running.

The company likewise has 5Y average (as determined from FY22-FY18) gross, running and net margins of 55.22%, 23.54% and 20.61% respectively. The fairly high and the same gross margin in specific highlights that NextEra’s core company operations pay and well run as proof by their significant gross revenue margin.

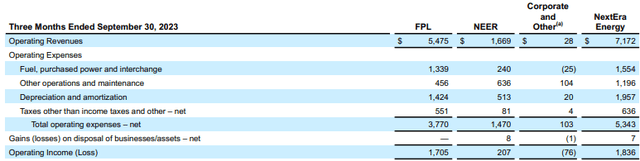

FY23 has actually been a primarily successful year for the company with their most current quarter seeing NextEra grow overall group earnings by 8% YoY thanks to strong efficiency by the company’s FPL company in specific.

FPL’s development in the 3rd quarter originated from continued financial investment in business causing a boost in clients by a count of 65,000 compared to the exact same duration in 2015. FPL continued to follow their tactical capital strategy targeted at providing impressive worth to its clients in among the faster-growing states in the whole United States.

The energy likewise handled to grow earnings all the while keeping their expenses well listed below the nationwide average with dependability and worth at the leading edge of FPL’s company operations.

General operating earnings for FPL was up 13% YoY thanks to capital enhancements reducing COGS for business sector all the while increasing the dependability and effectiveness of FPL’s facilities for the long-lasting.

NextEra’s NEER company saw flatline income development YoY in Q3 regardless of providing a record quarter of brand-new renewables and storage origination including around 3.245 MW to its stockpile considering that Q2. This overall wattage consisted of 1.485 MW of solar, 400MW of wind, 905MW of storage and around 455MW of wind repowering.

Changed incomes saw NEER produce $207M in running earnings with business still having a hard time to match the system economics of their recognized FPL energy.

Nevertheless, considered that the NEER sector is still growing, it will require time for their facilities to start yielding concrete returns from the invested capital and I completely anticipate that the company will have the ability to accomplish an operating margin of around 25% for business.

NextEra’s Q3 result total saw business produce primarily flatline non-GAAP operating earnings with earnings reducing from $1.7 B to simply $1.2 B in Q3 FY23 due to a 0.9 B after-tax problems on NEERs 2018 financial investment in NextEra Energy Partners.

Looking for Alpha’s Quant determines a “ B-” success score for NextEra which I think to be a primarily precise representation of the revenue producing power presently present at the company.

However, it needs to be kept in mind that NextEra is producing exceptional margins and returns from their company relative to their 5Y average with the company producing double digit gains compared to their running historical mean.

NextEra’s concentrate on development and financial investment into the renewables classification naturally has actually led to the company investing an extra 4$ B (a boost of 55%) on NEER’s renewable resource advancement with numerous on-going growth tasks using up a considerable part of money streams.

FPL likewise saw a $1B boost in capital investment utilized to enhance and improve existing energy facilities.

The net capital offered by running activities of $7.27 B was for that reason all utilized in investing activities with the company producing $2.78 B from funding activities (mostly the issuance of long-lasting financial obligation consisting of premiums and discount rates) and return from dividends & & capital circulations.

This left NextEra with a net money boost of $1.143 B with overall money and money equivalents positions at the end of Q3 amounting to $4B.

This enormous money balance is just one of the numerous examples of exceptional capital allotment present at NextEra with their balance sheet remaining in fantastic shape too.

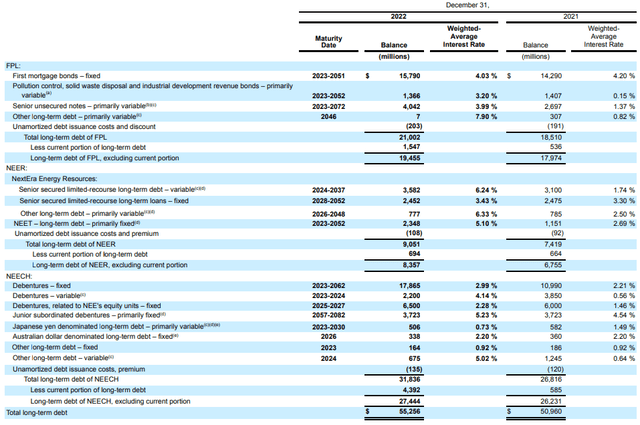

The company has $14.24 B in overall present possessions while overall present liabilities total up to $28.5 B. The enormous present liabilities are partially due to a big part of long-lasting financial obligation growing in the next 12 months in addition to significant short-term loanings and accounts payables of $6B.

However, this leaves NextEra with a quite low fast ratio of 0.23 x and an existing ratio of 0.50 x. NextEra’s Debt/Equity ratio is 1.56 x while the company runs on a monetary utilize ratio of 3.65 x.

While these liquidity metrics might appear rather restricted, it needs to be compared to other energy companies such as Evergy ( EVRG) who have a fast ratio of 0.08 x and an existing ratio of simply 0.39 x respectively.

Overall possessions for NextEra total up to $171.7 B while overall liabilities total up to simply $115.1 B. While the absence of fantastic short-term liquidity will probably leave the company needing re-financing a few of their growing long-lasting financial obligation at a greater rate, I do not think it will affect the company as adversely as anticipated, particularly if rate of interest fall in 2024 as anticipated.

At the close of Q3, NextEra had $59.2 B in long-lasting financial obligation up from the $55B revealed in their last FY22 10-K type. As highlighted by the table above (with little genuine modification taking place as an outcome of the extra $2B boost considering that FY22 end), NextEra has a primarily well staggered long-lasting financial obligation profile with a weighted typical rates of interest of around 3.5%.

Moody’s credit scores firm verified a Baa1 credit score for NextEra’s LT company score and senior unsecured domestic notes. The outlook stays steady. Moody’s categorizes “Baa1” credit scores as being of the greatest “speculative grade”, due to some speculative components existing in their score.

Looking For Alpha|NEE|Dividend

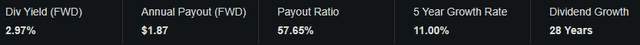

NextEra likewise pays a really terrific dividend to financiers with a 28-year development streak showing the company’s outright devotion to fulfilling investors. The FWD yield of 2.97% is excellent with a payment ratio of 57.65%.

Thinking about that the dividend made it through the dot-com crash and the 2008 monetary services problems, I think this is among the most safe and most trustworthy dividends presently readily available for financiers.

I excitedly wait for the Q4 incomes report which will ideally offer financiers with more assistance concerning FY24 expectations particularly in a macroeconomic environment where rate-cuts might take place which might even more reinforce NextEra’s development potential customers.

Evaluation

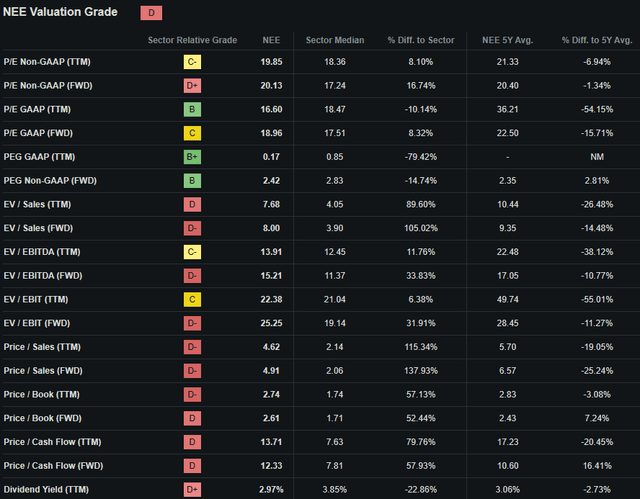

Looking For Alpha|NEE|Evaluation

Looking for Alpha’s Quant appoints NextEra with a “ D” Evaluation grade. I think this letter grade is an exceedingly downhearted representation of the worth present in NextEra stock and acts as an illustration of how extremely precise quant metrics can in some cases offer an imperfect understanding into the genuine worth of a stock.

The company presently trades at a P/E GAAP TTM ratio of 16.60 x. This represents a 54% decline in the ratio compared to their running 5Y average and is even 10.14% lower than the sector mean.

NextEra’s P/CF TTM of simply 13.71 x is 21% listed below their running 5Y average while their TTM EV/EBITDA of simply 13.91 x is extremely low compared to a 5Y mean of 22.48 x. The company’s Price/Sales TTM of 4.62 x is rather high nevertheless even regardless of the constant returns created by the energy.

While a lot of these ratios might appear rather raised compared to other sectors, energy companies usually trade at fairly high evaluation metrics offered the exceptionally trustworthy and constant returns created by these companies.

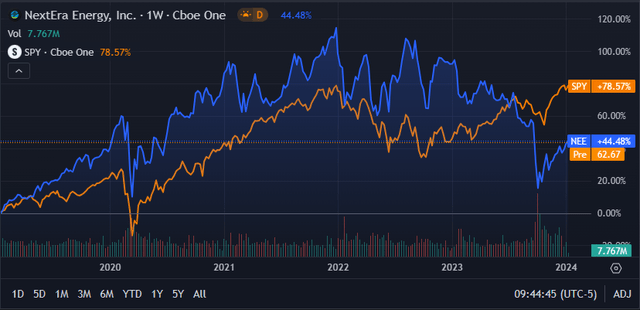

Looking For Alpha|NEE|Advanced Chart

From an outright viewpoint, NextEra shares are trading at a considerable discount rate relative to previous evaluations with present share rates of around $62.65 representing substantial 50% contraction relative to the high’s seen in mid-2022.

NextEra shares outshined the popular S&P 500 tracking SPY index for over 85% of the last 5 years with the current selloff and SPY gains eventually leading to the ETF beating the energy stock by around 30%.

The relative evaluation offered by basic metrics and ratios in addition to the outright contrast currently permit a fundamental understanding of the worth present in NextEra shares to be acquired particularly versus their historical highs. Nevertheless, a quantitative technique to valuing the stock is still necessary.

The Worth Corner

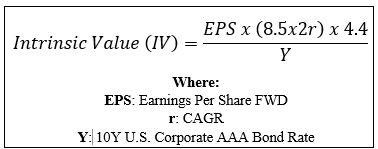

By using The Worth Corner’s specifically developed Intrinsic Evaluation Computation, we can much better comprehend what worth exists in the business from a more unbiased viewpoint.

Utilizing the company’s present share cost of $62.48, an approximated 2024 EPS of $3.40, a sensible “r” worth of 0.07 (7%) and the present Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74 x, I obtain a base-case IV of $71.20. This represents a modest 12% undervaluation in shares.

When utilizing a more downhearted CAGR worth for r of 0.06 (6%) to show a situation where an undesirable macroeconomic environment leads to lower than expect income development, shares are still valued at around $65.00 recommending an approximately reasonable evaluation in shares.

Thinking about the evaluation metrics, outright evaluation and intrinsic worth computation, I think that while shares are not trading at an enormous discount rate, NextEra remains in an excellent worth position relative to previous evaluations and the stability in returns used by the company.

In the short-term (3-12 months), I discover it challenging to state precisely what might take place to the energy company’s evaluation. Any intense economic crisis in the U.S. or abrupt shock to the economy might see shares topple even regardless of the currently marked down share cost.

Due to the fact that the short-term sees markets act more as voting makers than a worth weighing scale, I can not with confidence make any short-term predications due to the fundamental impracticality of the general public.

In the long-lasting (2-10 years), I think NextEra will continue to be a worldclass energy provider. Florida Power & & Light need to continue to produce fantastic returns for the business while concurrently providing customers fantastic rates thanks to the cost-efficient structure of the energy.

I likewise think NextEra’s renewables area will produce higher operating margins as the sector increases with the company’s infrastructural benefits recommending an enduring cost-advantage will be delighted in by the energy group.

Threats Dealing With NextEra

NextEra deals with some threat mostly developing from a constantly altering regulative environment for rate setting and from the company’s substantial financial investment into the renewables company.

While the state of Florida and FPL have actually just recently delighted in an excellent relationship with positive rate setting being concurred by the 2 entities, such a favorable circumstance is never ever a warranty. The deterioration in relations in between WEC and the state of Illinois highlights simply how quickly an altering regulative environment can impact the company’s underlying success.

Moreover, FPL has actually been implicated by numerous press outlets of project financing infractions which if discovered to be real might lead to an unfavorable charge versus the company.

NextEra’s renewables company likewise deals with some hazards especially from a greater rates of interest environment hindering the company’s development potential customers and total success. The financial investment into renewables will need a big quantity of capital which might come at a much greater expense ought to the present macroeconomic environment continue.

Any boost in the total expense of renewable resource production versus nonrenewable fuel source production might reduce the success and appearance of NextEra’s renewables portfolio. While the long-lasting outlook for renewables is favorable, it is challenging to forecast the timeframe in which renewables will surpass nonrenewable fuel sources.

From an ESG viewpoint, NextEra deals with little concrete hazards with the company striving to contribute towards a net-zero carbon economy. Moreover, I like that NextEra is working to make tidy energy a genuine cost-saver for customers instead of using it to greenwash their operations.

NextEra is profiting from renewables turning into one of the lowest-cost choices for numerous clients under different state and federal policies throughout the years while concurrently reducing the dependence of The United States energy facilities on nonrenewable fuel sources.

Offered the absence of concrete ESG hazards, I think NextEra might produce an engaging ESG mindful energy stock particularly compared to a few of their equivalents.

Obviously, viewpoints might differ with concerns to ESG product and I urge you to perform your own ESG and sustainability research study before purchasing NextEra if these matters are of issue to you.

Summary

NextEra is a top quality energies business with exceptional capital allotment, an excellent worth providing to customers and a constant desire to innovate identifying their core company operations.

The management group at NextEra remains in my viewpoint exceptional with the group excelling at directing the company through challenging macroeconomic environments by making sure a conservative technique to their balance sheets and development potential customers is preserved.

While FY23 has actually been less outstanding than previous years, the company is well on track to restore their stride particularly if rate of interest were to fall in 2024. When integrated with a fairly modest yet concrete 12% undervaluation in shares, I think now might be a good time to develop a position in this blue-chip energy.

For that reason, I rank NextEra a Strong Buy and have actually started a position worth 7% of my overall portfolio worth in the energy business.

Rather merely, I like the business, I like its management group and I discover the present evaluation appealing enough offered the relative premium that energy business generally trade at.