2023.12.14

Iâve been proper in my prediction that the Fed would pause in June, and hike a couple of times extra earlier than the top of the 12 months.

Iâve additionally voiced my opinion that we will be able to get a cushy touchdown without a, or a particularly shallow and really brief recession, with the essential proviso that the Fed pauses its rate-hiking cycle, which it has already carried out. For the Fed this implies the inflation price is coming down. Remarkably, the Federal Reserve has raised rates of interest excessive sufficient to opposite the inflation price, with out inflicting a critical downturn. And itâs carried out it in a particularly brief period of time.

In spite of those info, many consider a troublesome touchdown and a recession is coming. Daniel Lacalle, an influential economist, is one among them.

In keeping with Lacalle, whilst the 12 months is finishing with a bit of luck, with many buyers anticipating price cuts and an financial cushy touchdown, actually a cushy touchdown is an excessively uncommon tournament. âSince 1975, there were 9 price hike cycles, and 7 of them led to a recession,â Lacalle writes.

One commonplace false impression is the concept that of âtouchdownâ. In keeping with Lacalle, even a cushy touchdown is recessionary, as a result of it’s âan important decline within the combination cash provide, which includes decrease credit score and get entry to to capital for households and companies.â

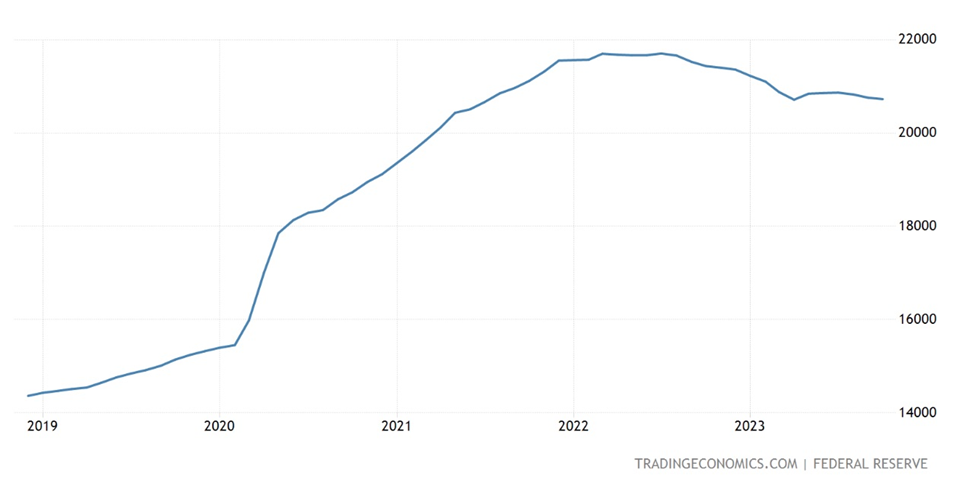

Arguably, that is what we see going down recently. M2 cash provide in the USA fell more or less 4% 12 months on 12 months in September, whilst within the euro space the wide financial combination M3 is shrinking too. The rates of interest on mortgages, automotive loans and private loans have all driven upper, with the Fedâs in a single day lending price sitting at 5-5.5%.

âThere’s no different option to decrease inflation, which the atypical and needless building up within the cash provide in 2020 brought about,â says Lacalle, and heâs proper.

2008 vs 2020

This brings up the query, why is there such excessive inflation now, in comparison to the monetary disaster in 2008, when the Fedâs quantitative easing program (4 rounds of it) injected trillions of greenbacks value of liquidity into the monetary device?

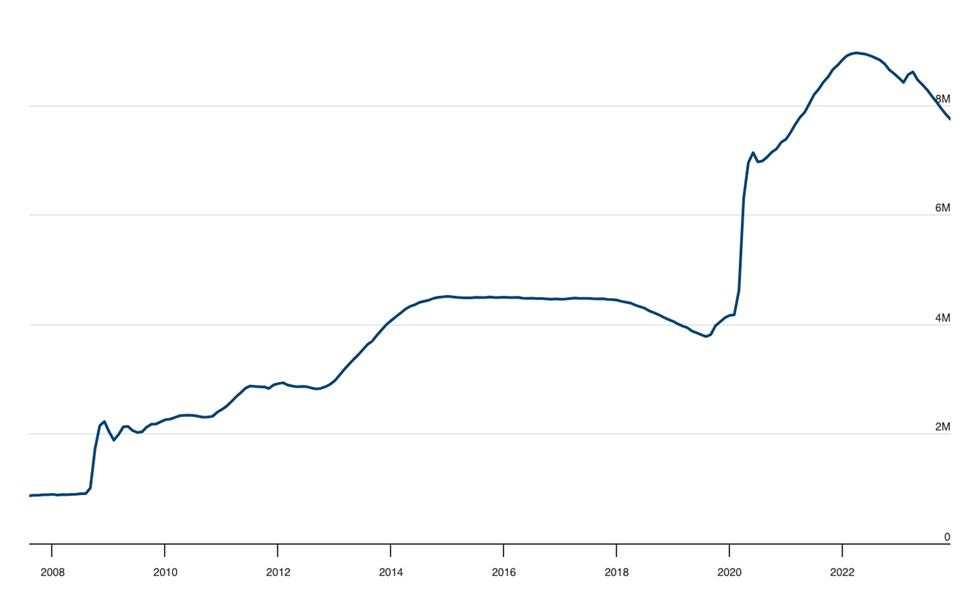

To struggle the Nice Recession, the Fed started âprinting cashâ (in fact they simply added it on a pc display screen, however the impact was once the similar). Between 2008 and mid-2014 the Fed higher their stability sheet from $800 billion to $4.5 trillion, thus serving to to recapitalize banks that had been in peril of going bankrupt, and restoring self belief within the economic system.

However many of the new cash by no means made its method into the economic system; it stayed inside the banks and far of it wasnât even leant out. We due to this fact didnât see any actual inflation. In truth all over this time inflation averaged about 1.6% a 12 months, beneath the Fedâs 2% goal.

As soon as the pandemic began in early 2020, the Federal Reserve resumed quantitative easing at a torrid tempo, inside weeks printing $3 trillion and once more decreasing rates of interest to 0%.

The important thing distinction between QE from 2008 to mid-2019, âquantifornicationâ I love to name it, and 2020, is that the Federal Reserve purchased up US executive debt (Treasuries) to fund a large quantity of presidency spending that were given added to the nationwide debt recently sitting at just about $34T.

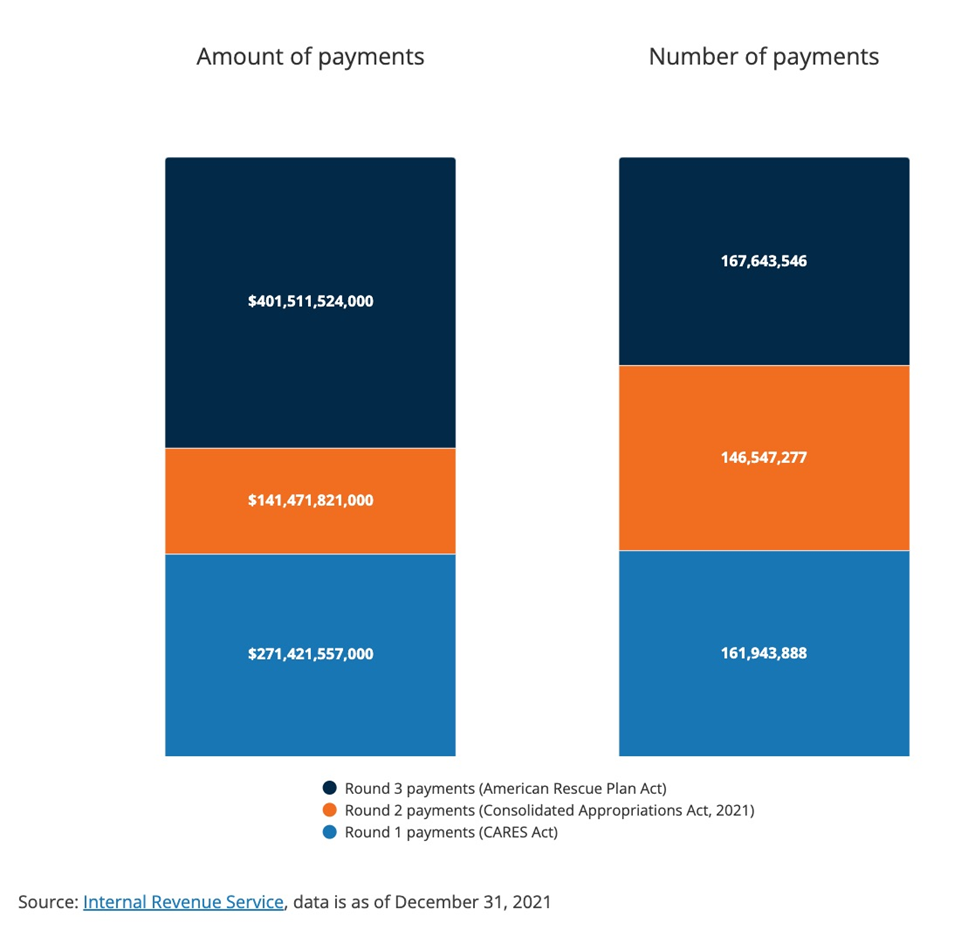

US politicians had been keen to spend no matter it took to get the economic system transferring once more and to deal with a bullish inventory marketplace. First there was once the $2.2 trillion CARES Act handed by means of then-President Trump. It was once adopted in early 2021 by means of President Bidenâs $1.9 trillion covid reduction invoice.

All of this pandemic-related spending dramatically higher the âM2â cash provide, proven beneath.

From March 2020 to November 2021, the Fed greater than doubled its stability sheet to $8.7 trillion. The central financial institution raised its per thirty days bond purchases to $120 billion in December 2020, pronouncing that the tempo would proceed till there was once âconsiderable additional developmentâ within the financial restoration.

The government too demonstrated its willingness to âdo the restâ to get an financial restoration and that integrated sending stimulus assessments to particular person American citizens.

In keeping with Pandemic Oversight, greater than 476 million bills totaling $814 billion in monetary reduction went to families impacted by means of the pandemic.

In 2008 common other people won no such bills, actually the principle recipients of US executive generosity had been the banks and massive US firms. In keeping with MIT, the direct price of the 2009 bailouts was once $498 billion. Of this, the Treasury Division was once approved to shop for as much as $250 billion in financial institution stocks, which it later bought for a benefit, from amongst Stricken Asset Aid Program (TARP) help totaling $245.1 billion. Executive capital fusions into Fannie Mae and Freddie Mac totaled $191.5 billion.

This additionally explains why monetary disaster fiscal coverage was once no longer inflationary while 2020 fiscal coverage was once, and is â all of the cash or maximum of it in 2008-09 stayed inside the banks or huge firms, and nearly none of it made it into the economic system. Against this, in 2020-21 $814 billion was once given at once to American citizens. In the USA shopper spending accounts for more or less two-thirds of GDP. How have American citizens spent that cash? Thereâs no method of realizing evidently. Some socked it away in financial savings accounts, others used it to shop for bitcoin and meme shares, however a significant portion spent it on items and products and services, serving to to pressure the commercial restoration in addition to pushing inflation upper.

Lacalle has a extra technical cause of no inflation between 2008 and 2019. Quoting from Richard Burdekinâs paper âThe USA Cash Explosion of 2020: Monetarism and Inflationâ, he says âthe important thing level is that the decline within the cash multiplier in large part offset the large building up in base cash.â

In undeniable English, because of this the Fed gave the cash to the banks which then held it of their reserves. They didnât mortgage a lot of it out although that was once the purpose. This additionally constrained the cash provide and restricted the rate of cash, which is the tempo at which cash adjustments fingers all the way through the monetary device.

Against this, in 2020 there was once no longer an enormous building up in financial institution reserve holdings. Between February and September 2020, Lacalle says the financial base rose from $3.4 trillion to $4.8 trillion, whilst M2 cash provide went from $15.4T to $18.6T, an building up of 20.7%.

âSince then, collected inflation in the USA has exceeded 20%, and price hikes, added to a discount of the stability sheet of the key central banks, had been the solution to containing the upward push in costs.â

The Fed pause

The Fed is on pause. A wait and notice method â have they carried out sufficient to chill inflationary force, turns out like, or do they want to lift, probably two times extra, to get inflation into their most popular Goldilocks zone?

If, as such a lot of consider, we’re in a recession, or will likely be in a while, itâll be so shallow and temporary it’ll be over lengthy over earlier than itâs even known as a recession in the midst of 2024.

All of us want to keep in mind, the Fed didnât wish to lift rates of interest. Thatâs why it took see you later for them to decide to a tightening program and there was once all that speak about inflation being âtransitoryâ.

Once they did, they hiked with a vengeance, striking rates of interest upper 11 occasions in beneath two years, realizing that traditionally, that is one of the simplest ways to engineer a cushy as opposed to a troublesome touchdown.

Now the Fed is ready to look how a lot injury the speed will increase have carried out to the economic system.

The lag impact

We all know that cash provide enlargement has been adverse for the previous 12 months. Yr to this point, the decline is -4.5%. In truth, itâs the primary decline in cash provide for the reason that Thirties.

This must have a adverse impact at the economic system, however in line with Lacalle, the rationale itâs no longer, âis for the reason that quantity of liquidity injected in 2020â21 was once so monumental that there’s a lag impact as financial savings are fed on, and the collected cash enlargement impact helps to keep credit score prerequisites slightly free.â

In impact what heâs pronouncing is that issues are going to get a lot tougher for the American shopper, as they run out of financial savings, loans will likely be renewed at upper charges, and credit score most often will likely be tougher to get.

That is one more reason the Fed is on pause; theyâre looking forward to the lag impact make its method in the course of the economic system. For my part there are 3 possible results: primary, the Fed sees the economic system working too scorching, with inflation nonetheless too excessive, and comes to a decision to bump up charges as soon as, perhaps two times extra. Quantity two, the Fed does not anything and helps to keep ready for more info on which to come to a decision. Quantity 3, the economic system takes a big flip for the more serious, and the Fed thinks it has to decrease charges, say 25 foundation issues, simply to inject some optimism and warmth the economic system again up.

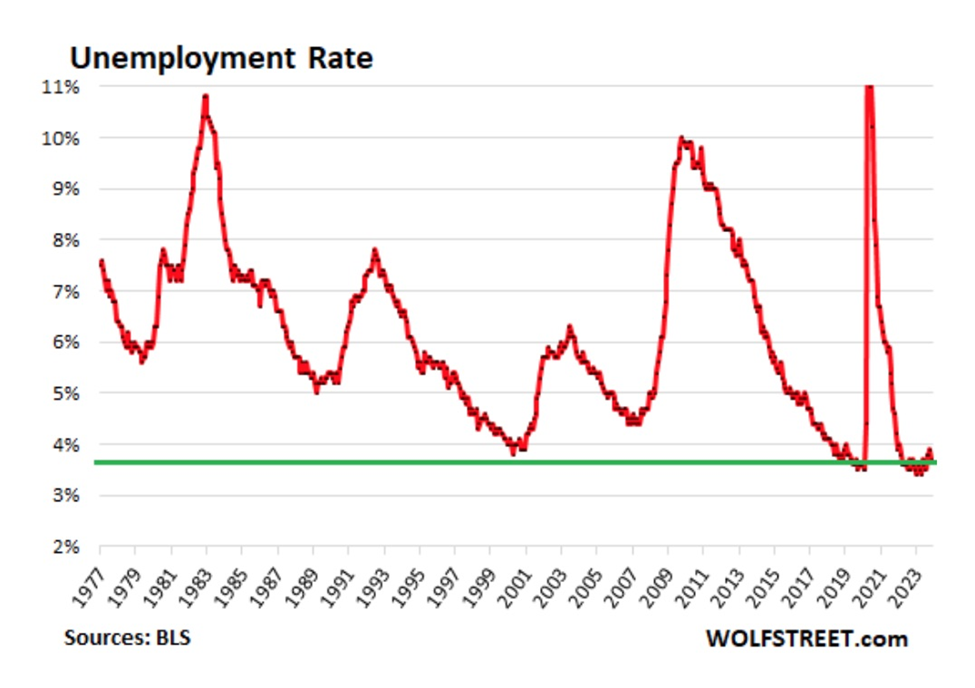

(Wolf Boulevard asks why the Fed would âpivotâ to a couple of price cuts beginning within the first quarter of 2024, with the hard work marketplace booming. Reasonable hourly profits grew for the 3rd month in a row, emerging at an annualized 5% in November. Additionally, products and services inflation remains to be working scorching, at 4.6% in line with the PCE value index and 5.5% in line with CPI. To look how traditionally low the unemployment price is, view the chart beneath over the last 40 years.)

In Lacalleâs view, the issue is that inflation stays increased. The CPI rose 3.2% in October, with core CPI (apart from meals and effort) hitting 4%. However right hereâs one thing fascinating. Because of the continuing decline within the cash provide, Lacalle says inflation must already be beneath 2%.

âExecutive spending and large intake of newly created gadgets of foreign money are preserving inflation above the place it must be,â he writes.

âIf subsequent 12 months we see price cuts and cash provide enlargement, collected inflation from 2019 will most likely surpass 23%, when it stands at 20.3% in the newest determine.â

Ouch. When you assume that receivedât have a big affect at the reasonable Americanâs spending behavior, you havenât been paying consideration.

Letâs take a more in-depth have a look at higher executive spending. Lacalle maintains that inflation can be coming down quicker if it werenât for the truth that, âfiscal coverage, for the primary time in many years, is transferring in the wrong way of economic coverage. And that is more likely to create vital issues one day.â

We first identified this conflict between the government and the Federal Reserve again in 2018, when Trump was once president. The Fed on the time was once elevating rates of interest, to the discontentment of Trump who sought after to stay them low.

Imagine: Because the Fed pursues a good financial coverage, unwinding its stability sheet and elevating rates of interest, the Treasury is printing cash that the government helps to keep spending to satisfy its many guarantees. The Biden managementâs 3 signature items of law â the Inflation Relief Act, the Bipartisan Infrastructure Regulation and the CHIPS and Science Act â are costing trillions.

Take note too, that almost all of this promised cash has but to be spent.

Unsurprisingly, inflation has added an enormous bite to development undertaking prices, which has additionally supposed delays. An Economist article notes that the most important part of the infrastructure bundle was once a 50% building up in investment for highways to $350B over 5 years. However freeway development prices soared by means of greater than 50% from the top of 2020 to the beginning of 2023, in impact wiping out the additional investment.

Every other downside is âPurchase The usâ laws requiring developers to supply fabrics at house, along side touchy-feely necessities to advertise racial equality, truthful wages, and environmental sustainability.Â

The regulation integrated greater than 100 new aggressive grant systems, which require new software programs and new compliance procedures. Some state and native officers aren’t even bothering to use for investment.

The usâs separation of powers between the government and the states has additionally thrown a wrench into infrastructure enhancements:

There’s a substitution impact as the coming of federal cash lets in states to step apart and spend much less on development. A contemporary wave of tax cuts by means of states has been made conceivable partly by means of the gusher of federal money.

Getting lets in is but some other impediment, acquainted to these in mining.

The government helps to keep spending cash and the Treasury helps to keep printing it, to hide the deficits which stay mounting. Round $13 trillion in executive debt is predicted to roll over subsequent 12 months, at a lot upper charges, which means extra money-printing is at the method.

Gold blip

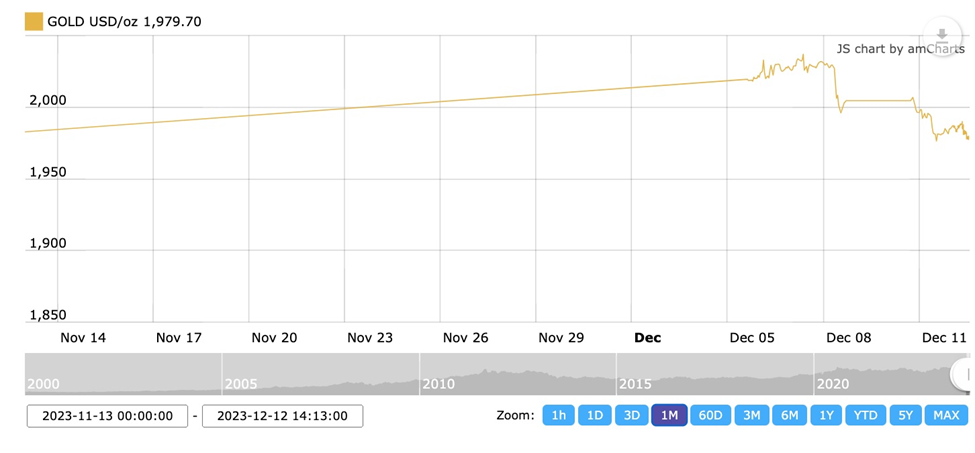

Getting again to the theory of a cushy touchdown, many buyers previous this month positioned a chance on bullion once they figured the Fed was once making plans to decrease rates of interest in 2024. Spot gold hit a brand new record-high $2,100 an oz on Dec. 3. Then again, as we argued in Gold no longer but, copper will retest $4, gold isn’t going a lot upper till the buck begins weakening (america buck index DXY remains to be smartly above 100), and now we have adverse actual charges. With inflation recently at 3.1% and the yield on america 10-year Treasury at 4.2%, actual charges are recently +1.1%.

The gold value as of this writing is $1979.80, 6% not up to the $2,100 checklist set on Dec. 3.

The course of a weakening buck is obvious, with the Federal pausing its tightening cycle after a sequence of rate of interest hikes. However weâre no longer there but. If and when he Fed cuts charges in 2024, it’ll weigh on each US Treasury yields and the dollar â each positives for gold.

Every other level is weâre no longer inside the âgold to the moonâ camp of people that assume gold goes to $5,000. How adverse would actual rates of interest must get for a gold value that top? It might nearly definitely imply a complete cave in of the worldwide financial device. No longer one thing weâd wish to see or a global weâd wish to are living in.

Central financial institution gold purchasing

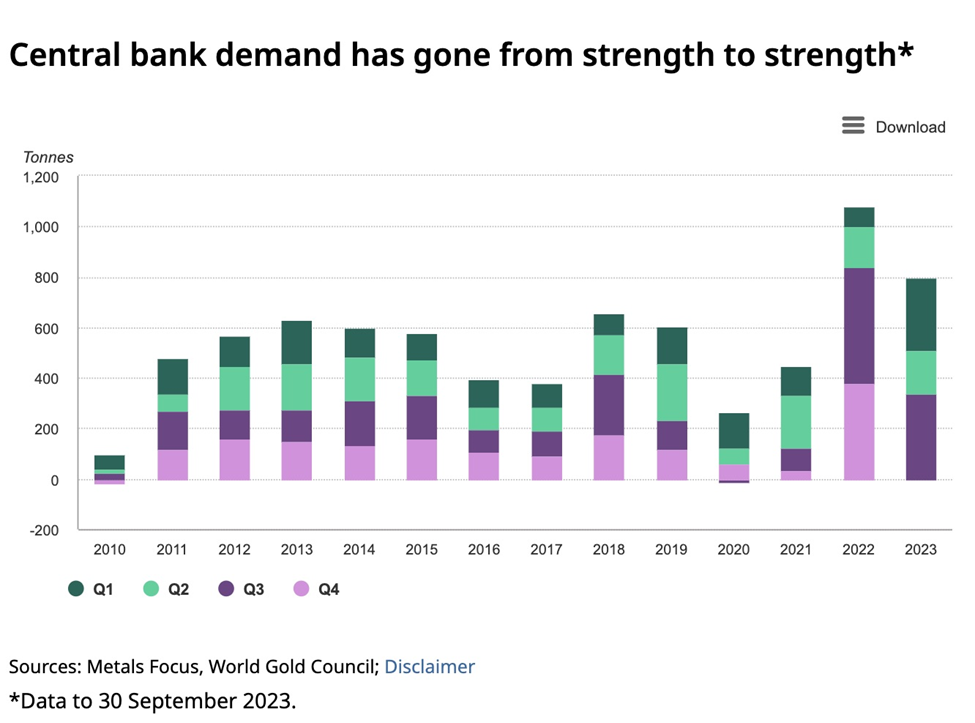

Making an allowance for the extra chance to foreign money destruction that 2024 brings, it’s not sudden to look central banks loading up at the valuable steel. Lacalle notes that central banks have reached a checklist determine of purchases of gold within the first 3 quarters of 2023, surpassing the 800-tonne stage. This checklist determine of gold purchases by means of central banks, a 14% building up from the 2022 stage, displays the want to enhance and diversify their reserve base, decreasing the publicity to sovereign debt, which has created web losses prior to now two years, and lengthening the holdings of an asset, gold, that promises steadiness and emerging buying energy through the years.

In keeping with the Global Gold Council, central banks purchased 337 tonnes within the 3rd quarter, which is the second-highest Q3 on checklist.

Gold ETF gross sales sluggish

In some other sure development for gold, the drift of steel out of gold-backed alternate traded finances (ETFs), slowed significantly in November. North American finances noticed gold drift in quite than out for the primary time in 5 months, recording a ten.4-ton building up. 9 heaps moved out of ETFs globally, which have been valued at $212 billion as of Dec. 1.

Financial debasement & De-dollarization

Alternatively, issues are definitely transferring within the course of economic basement. Daniel Lacalle says âthe large destruction of the buying energy of the foreign money continues,â with âgold now the one actual protection towards the lack of the buying energy of fiat currencies.â

Some might say that bitcoin is an inflation-fighting choice to gold, however Lacalle isnât one among them, and neither are we. Thatâs as a result of âbitcoin, shares, and bonds are all at once correlated with the expectancies of a bigger cash provide and decrease charges, however none of them are efficient tactics to offset the consistent and inevitable destruction of currencies.â

During the last few years, âde-dollarizationâ is being pursued by means of nations with agendas at odds with america, together with Russia, China, Saudi Arabia and Iran.

Greenback cave in will occur âsteadily, then abruptlyâ

As Reuters famous in a tale on Would possibly 25, Contention with China, fallout from Russiaâs struggle in Ukraine and wrangling as soon as once more in Washington over the U.S. debt ceiling have put the buckâs standing as the sectorâs dominant foreign money beneath recent scrutiny.

One of the crucial telling indicators of de-dollarization is the decline of the buckâs percentage of reputable foreign currencies reserves. The principle reason why this is going on, is central banks diversifying to different currencies, following Russiaâs invasion of Ukraine. When the USA punished Russia by means of freezing part of its $640 billion in gold and FX reserves, different nations idea âthe similar factor may occur to themâ. A few of the nations re-thinking their foreign currencies composition, are Saudi Arabia, China, India and Turkey.

Moreover, commodity-producing nations have began engaging in industry in currencies as opposed to the dollar. For instance, India has began buying Russian oil in UAE dirham and roubles, China paid for $88 billion value of Russian oil, coal and steel in its house foreign money, the yuan, and Chinese language state-owned oil corporate CNOOC and Franceâs TotalEnergies in March finished their first yuan-settled LNG industry.

In keeping with the Financial institution of World Settlements, the yuanâs percentage of world foreign exchange transactions went from nearly not anything 15 years in the past to 7%.

The Day by day Bell notes that, because the yuanâs affect will increase, different nations will get started retaining extra of it, to industry with China, which means much less call for for bucks.

President Emmanuel Macron is urging Europe to develop into unbiased from US overseas coverage and to depend much less at the buck. In spite of being one among Americanâs oldest allies, France, as discussed, finished its first liquefied herbal fuel industry settled in yuan.

Prior to that, China purchased LNG from the UAE the use of its personal foreign money.

Most significantly, Saudi Arabia is reportedly open to breaking the petrodollar and to promote oil in yuan. In keeping with the Wall Boulevard Magazine,

The talks with China over yuan-priced oil contracts had been on and off for 6 years however have speeded up this 12 months because the Saudis have grown increasingly more unsatisfied with decades-old U.S. safety commitments to protect the dominion, the folks stated.

Malaysia, in the meantime, struck a care for India to industry within the rupee and its Top Minister has proposed an âAsian Financial Fundâ to scale back dependence on america buck, The Day by day Bell states.

Including credence to the perception that US buck hegemony has peaked, Bloomberg macro strategist Simon White argues that hegemony isn’t concerning the buckâs price, quite, itâs concerning the buckâs position within the international monetary device. His article carried by means of 0 Hedge items 4 charts proving that buck dominance is beginning to be challenged.

In spite of everything, an article on Greenback Cave in notes that 3 occasions came about inside a a little while to reinforce de-dollarization. They’re:

- The covid-19 pandemic, which ended in lockdowns and stimulus, âblew the âfirst 3 Dâsâ of the gold bull thesis â debasements, deficits and debt â to much more absurd proportions.

- The weaponization of the monetary device towards overseas adversaries, discussed above, modified the calculus of retaining USD overseas reserves.

- US âexoribitant privilegeâ changed into extra conspicuous and overt.

âNow, âde-dollarizationâ isnât some unthinkable situation, itâs a factor,â writes Mark Jeftovic. âThe BRICs are already making plans an alternate device and weâre seeing extra transactions that had been in the past settled solely in USD, being settled in choice currencies â together with gold.

The newest instance is Zambia, with Trade Insider reporting the Financial institution of Chinaâs workplace in Zambia is pushing the yuan for use in additional trades with Africaâs moment biggest copper manufacturer and its neighbors.

And this simply in: China is once more dumping US bucks in international foreign money markets to offer protection to the yuan. Watcher.Guru stories Chinese language state-run banks offloaded bucks within the spot foreign currencies markets on Dec. 4-6, after scores company Moodyâs minimize Chinaâs outlook to adverse.

There may be even an concept, sounded out by means of The Mum or dad, that it’s time to make Russia pay for its struggle in Ukraine by means of confiscating the $300 billion in Russian central financial institution belongings recently frozen by means of Western states!

If this occurs, it’ll be a big catalyst for de-dollarization. Each and every growing nation will in an instant forestall the use of the buck as a result of they notice that their buck holdings might be frozen and bought on the whim of america Congress.

Purchasing useless vegetation

Institutional buyers generally tend to favor investments which can be idea to include the possibility of enlargement, enlargement = sprouts. An funding has to provide a rising income move â if it doesnât develop it doesnât compound. Silver and gold are rejected as investments as a result of they donât produce sprouts, which means the secure source of revenue and systematic enlargement so wanted by means of institutional buyers simply isnât there.

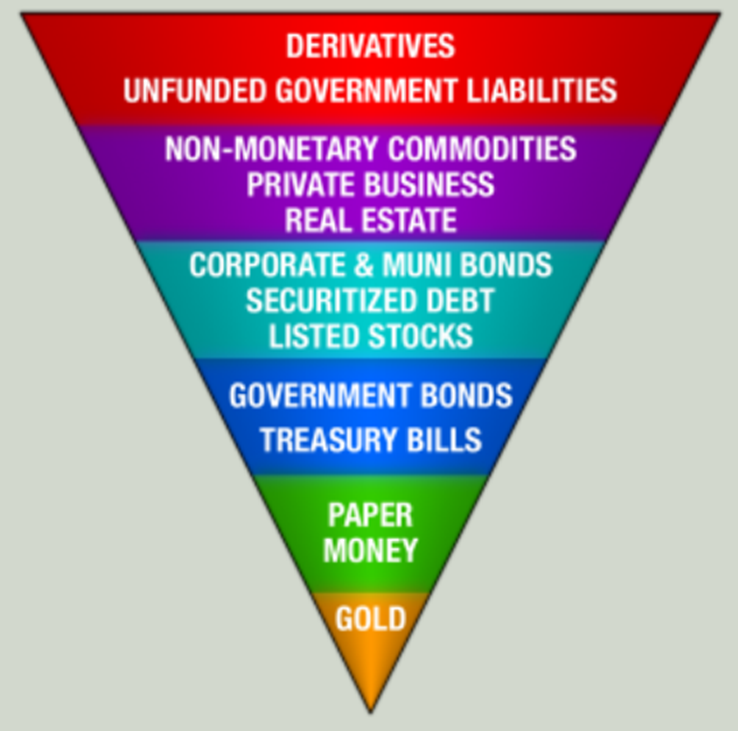

John Exter was once an American economist and a member of the Board of Governors of the USA Federal Reserve Device. Exter is understood for developing Exterâs Pyramid â helpful for visualizing the group of asset categories relating to chance and dimension.

When the credit score device is increasing most monetary flows to the highest of the pyramid â the increasingly more speculative and illiquid investments. When the credit score device comes beneath force and debt can’t be repaid, the pieces on the best of the pyramid get bought and cash flows in opposition to the ground.

âWith a purpose to employ it although, we should first make the respect between actual wealth and claims on wealth. Actual wealth is represented by means of precise pieces that folks need or want. This can also be meals, land, herbal assets, constructions, factories and so forth. Monetary belongings, proven as layers within the pyramid, constitute claims on actual wealth. In an absolutely evolved monetary device, in just right perceived status, there’s a excessive ratio of claims on wealth to precise underlying actual wealth. On this atmosphere the typical purchasing energy of the monetary belongings is decrease. It will very best be seen by means of taking a look on the buying energy on the backside of the pyramid. Gold is at a minimal right here. It’s competing with all the different claims on wealth for a slightly consistent quantity of underlying actual belongings.

In keeping with Exterâs concept of cash, when economies get into hassle in the course of the accumulation of an excessive amount of debt, the degrees of the pyramid disappear so as from absolute best to lowest. Because the pyramid contracts downward, the remainder layers constitute a proportionally upper declare on the actual underlying wealth. In different phrases their price will increase. The use of gold as our reference level, itâs relative buying energy will increase because the pyramid contracts. Gold reveals itself in a mundane bull marketplace.

Within the excessive hypothetical case the place all different asset categories are destroyed, together with the foreign money itself, handiest gold stays. On this case the holders of gold compete without a different monetary belongings for claims at the underlying wealth. This situation represents without equal clearing of the economic system. All foreign money denominated money owed had been cleaned.

If a marketplace economic system stays in position then the pyramid starts to increase and develop once more. The wealth claims represented in gold will likely be deployed as investments and a brand new foreign money will emerge that garners the religion of those that use it. As this new economic system grows and expands, the former tools of credit score and financing will seem once more. Layer upon layer are added again to the pyramid.

From the point of view of gold, its relative buying energy decreases because it competes with those new monetary belongings for claims at the underlying actual wealth. Gold is in a mundane endure marketplace as the most recent ranges of the pyramid are of their enlargement segment. This style supplies an invaluable intuitive figuring out of the alternating secular bull and endure markets of commodities vs. equities.â Hint Mayer, The Paper Empire

Conclusion

De-dollarization is one reason why for central banks to possess gold however the larger rationale for gold purchases is the destruction of fiat currencies.

Lacalle writes that âGold is now the one actual protection towards the lack of the buying energy of fiat currencies. Making an allowance for that central banks need to impose their very own virtual currencies, gold proves once more that it’s an crucial asset in a portfolio the place buyers attempt to get away the cave in of cash as we comprehend it.

âThe issue in 2024 is that cushy landings are uncommon, that financial contraction and price hikes will display their true affect with the everyday lag of twelve to 14 months for the reason that remaining hike, and that the governmentâs fiscal coverage will proceed to pressure deficits and debt upper, this means that eating extra newly created gadgets of foreign money and debasing our salaries and financial savings. If the specter of central financial institution virtual currencies is showed, gold will turn out once more its high quality as a reserve of price and way of cost, however it is usually more likely to display that it is among the few belongings that protects buyers in a recession.â

Certainly, fiat currencies are being destroyed on account of reckless money-printing by means of governments and this is why to possess gold.

Ascent of central financial institution virtual currencies bodes smartly for gold

You donât acquire gold to make the most of temporary value fluctuations available in the market, you purchase it as a result of it’ll all the time acquire in price in comparison to paper cash.

Through the years, gold is a shop of price as a result of it’s not topic to the inflationary pressures fiat currencies are. Since 1913, when the Federal Reserve was once created, america buck has misplaced 96% of its price.

The atypical price of gold as opposed to bucks is definitely grasped by means of engaging in just a little idea experiment. Letâs say you had been 18 years previous in 1971, and simply starting your operating existence. In 5 years time you are making some good investments and organize to financial institution $100,000. At age 23 you’ve gotten a choice to make: Is it higher to plug that cash right into a retirement financial savings plan, or purchase $100,000 value of gold, which in 1976 is buying and selling at $125/oz.? You make a decision to shop for gold.

Speedy ahead 47 years. You are actually 70 years previous and in a position to retire. In 2023, gold is value $2,000 an oz â 16 occasions what you purchased it for in 1976! The gold bars and cash simply sat there in a protected, no longer incomes passion. The 800 oz you purchased at $125/oz. ($100,000) are actually value $1.6 million. This retirement nest egg would simply see you via to the ripe previous age of 85, and thatâs by means of taking flight $106,000 a 12 months. Are living extra modestly, and you should are living to 100. Or go away a number of cash on your youngsters, grandchildren, or charity.

Take note, that is along with no matter you controlled to save lots of, most likely along with an organization or executive employee pension. We arenât even counting what youâd obtain from executive pension plans.

Examine this to what would have came about in the event youâd have simply caught to a typical 401-k plan. It’s possible you’ll get to live to tell the tale $1,500-$2,000 a month, plus some further financial savings in the event you had been fiscally prudent and fortunate.

There are a couple of causes to industry gold â US buck actions, geopolitical tensions, ETF outflows, central financial institution purchasing, adverse actual charges, and so forth., however just one reason why to possess it: keeping up your buying energy towards buck (or different foreign money) losses incurred by means of inflation.

We will handiest bet what the Federal Reserve goes to do subsequent 12 months. We are hoping the Fed will get it proper and now we have a cushy touchdown, however we donât know evidently. What we do know is that every one currencies are vulnerable, theyâre no longer âactual cashâ, and that each and every portfolio must have a share of bodily gold.

Richard (Rick) Generators

aheadoftheherd.com

subscribe to my loose e-newsletter

Felony Understand / Disclaimer

Forward of the Herd e-newsletter, aheadoftheherd.com, hereafter referred to as AOTH.

Please learn all the Disclaimer moderately earlier than you utilize this site or learn the e-newsletter. If you don’t conform to all of the AOTH/Richard Generators Disclaimer, don’t get entry to/learn this site/e-newsletter/article, or any of its pages. Via studying/the use of this AOTH/Richard Generators site/e-newsletter/article, and whether or not you in fact learn this Disclaimer, you’re deemed to have permitted it.

Any AOTH/Richard Generators report isn’t, and must no longer be, construed as an be offering to promote or the solicitation of an be offering to buy or subscribe for any funding.

AOTH/Richard Generators has primarily based this report on knowledge acquired from assets he believes to be dependable, however which has no longer been independently verified.

AOTH/Richard Generators makes no ensure, illustration or guaranty and accepts no duty or legal responsibility as to its accuracy or completeness.

Expressions of opinion are the ones of AOTH/Richard Generators handiest and are topic to switch with out realize.

AOTH/Richard Generators assumes no guaranty, legal responsibility or ensure for the present relevance, correctness or completeness of any knowledge equipped inside this File and might not be held answerable for the outcome of reliance upon any opinion or commentary contained herein or any omission.

Moreover, AOTH/Richard Generators assumes no legal responsibility for any direct or oblique loss or injury for misplaced benefit, which you will incur on account of the use and lifestyles of the tips equipped inside this AOTH/Richard Generators File.

You compromise that by means of studying AOTH/Richard Generators articles, you’re performing at your OWN RISK. In no tournament must AOTH/Richard Generators answerable for any direct or oblique buying and selling losses brought about by means of any knowledge contained in AOTH/Richard Generators articles. Knowledge in AOTH/Richard Generators articles isn’t an be offering to promote or a solicitation of an be offering to shop for any safety. AOTH/Richard Generators isn’t suggesting the transacting of any monetary tools.

Our publications aren’t a advice to shop for or promote a safety â no knowledge posted in this website is to be regarded as funding recommendation or a advice to do the rest involving finance or cash with the exception of acting your personal due diligence and consulting with your own registered dealer/monetary consultant.

AOTH/Richard Generators recommends that earlier than making an investment in any securities, you discuss with a qualified monetary planner or consultant, and that you just must behavior a whole and unbiased investigation earlier than making an investment in any safety after prudent attention of all pertinent dangers. Forward of the Herd isn’t a registered dealer, broker, analyst, or consultant. We grasp no funding licenses and won’t promote, be offering to promote, or be offering to shop for any safety.