{“page”:0,” year”:2023,” monthnum”:11,” day”:28,” name”:” finding-fee-savings-in-fixed-income”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”}]

Finding Cost Cost Savings in Fixed Earnings

Among the advantages of indexing is its low expense relative to active management. As indexing has actually grown, financiers have actually benefited considerably by minimizing charges and preventing active underperformance. These advantages are not restricted simply to equities however have actually likewise encompassed other possession classes consisting of the set earnings area, where charges can play an especially essential function

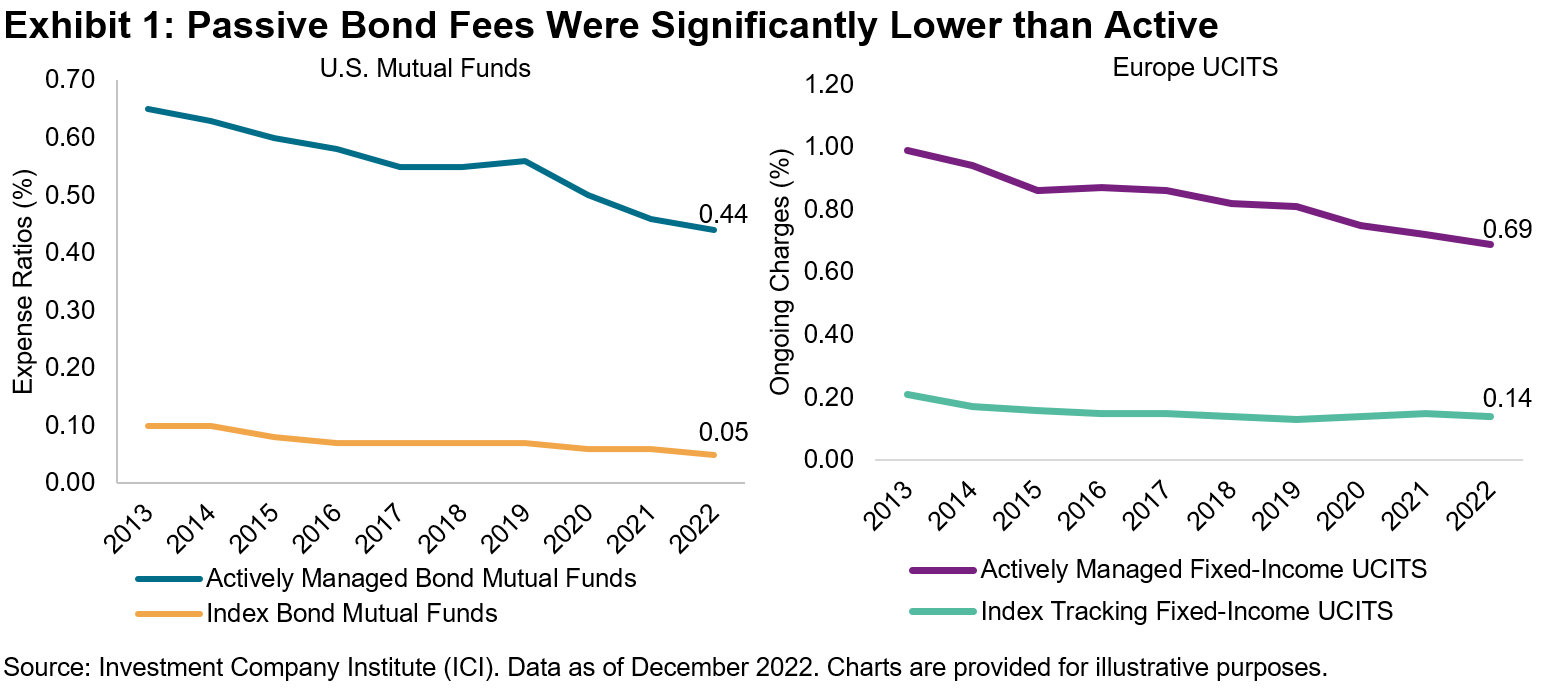

In Display 1, we see that index mutual fund expenditures in the U.S. and Europe have actually been regularly lower than their active equivalents for the previous years. While that spread has actually narrowed over the last few years, we still observe a charge differential of 39 bps in the U.S. and 55 bps in Europe since 2022.

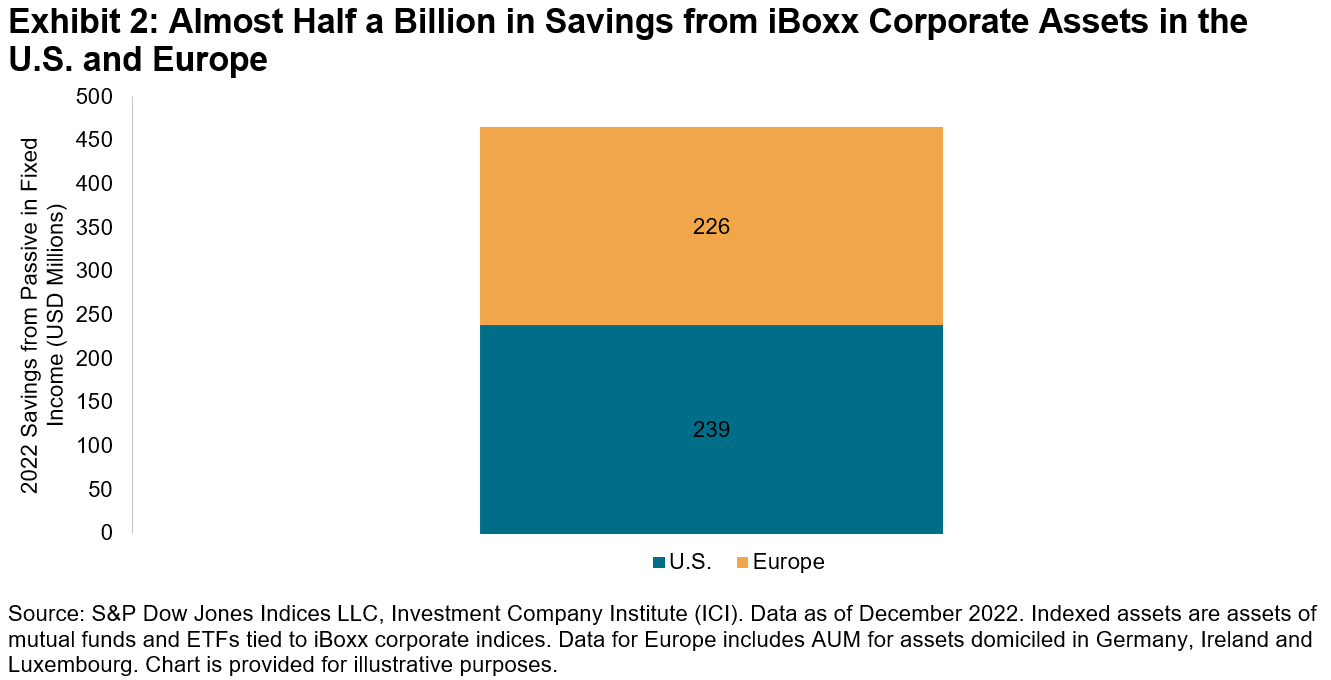

Utilizing the exact same typical charge differentials in between active and passive set earnings funds in the U.S. and Europe, as used regionally to roughly USD 102 billion of properties bought shared funds and ETFs tracking iBoxx business bond indices in both areas, we can approximate a present run rate of equivalent to a minimum of USD 465 million each year in charge cost savings made by passive financiers thanks in part to the iBoxx series (see Display 2).

Obviously, this USD 465 million quote downplays the complete expense savings of the set earnings index market, given that it includes funds tracking just choose indices from S&P Dow Jones Indices in the U.S. and Europe.

Our Yearly Study of Indexed Possessions programs worldwide properties tracking our iBoxx Corporate indices were USD 121 billion since December 2022 (this likewise consists of institutional segregated requireds, in addition to properties outside the U.S. and Europe). To supply context on the size of the passive market in set earnings, this number comprises just 1% of the worldwide overall of USD 11.5 trillion in properties of all open-end mutual fund 1 and just around 0.5% of worldwide ranked business financial obligation exceptional. 2 Simply put, there is lots of headroom for future passive development in set earnings, and the potential customers for higher charge cost savings are appealing.

Clearly, the cost savings produced by the shift from active to passive management would be of no alleviation if financiers lost more in efficiency shortages than they got in minimized charges. As readers of our SPIVA ®(* )reports might understand, in the 15 years ending in June 2023, 94% of all actively handled General Financial investment Grade mutual fund lagged the iBoxx $ Liquid Financial investment Grade Index High Yield outcomes were nearly similarly frustrating. As indexing in set earnings has actually acquired momentum, bond market individuals have actually gained from charge cost savings and avoidance of active underperformance, an effective mix. 1

2023 Investment Firm Reality Book , Investment Firm Institute. Managed open-end funds consist of shared funds, exchange-traded funds (ETFs) and institutional funds. 2

Credit Trends: Global State of Play: Financial Obligation Development Diverging by Credit Quality. Level of worldwide ranked business financial obligation reached USD 23.2 trillion since July 1, 2023. The posts on this blog site are viewpoints, not suggestions. Please read our

The

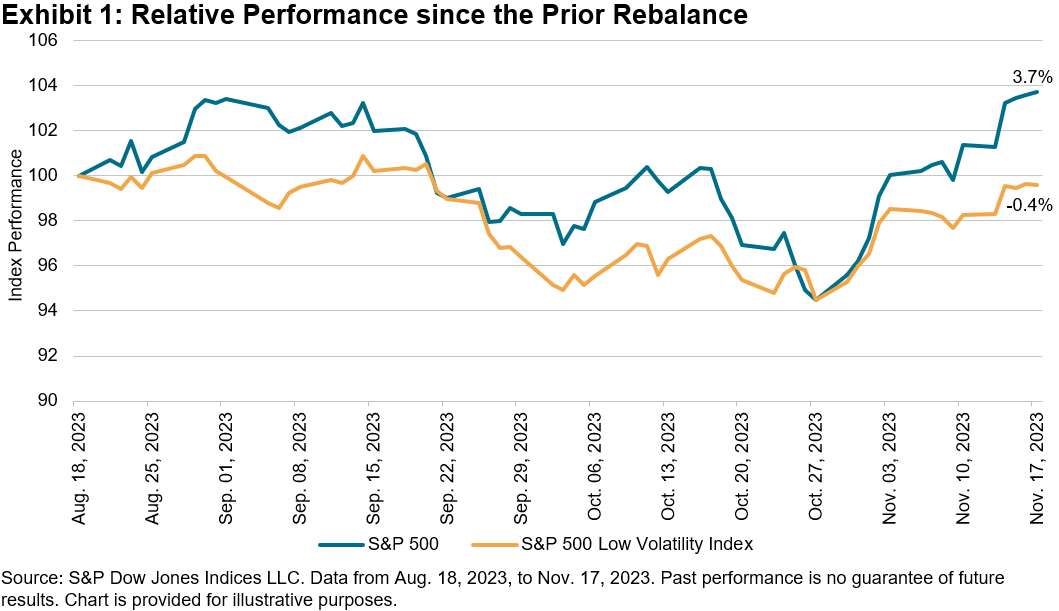

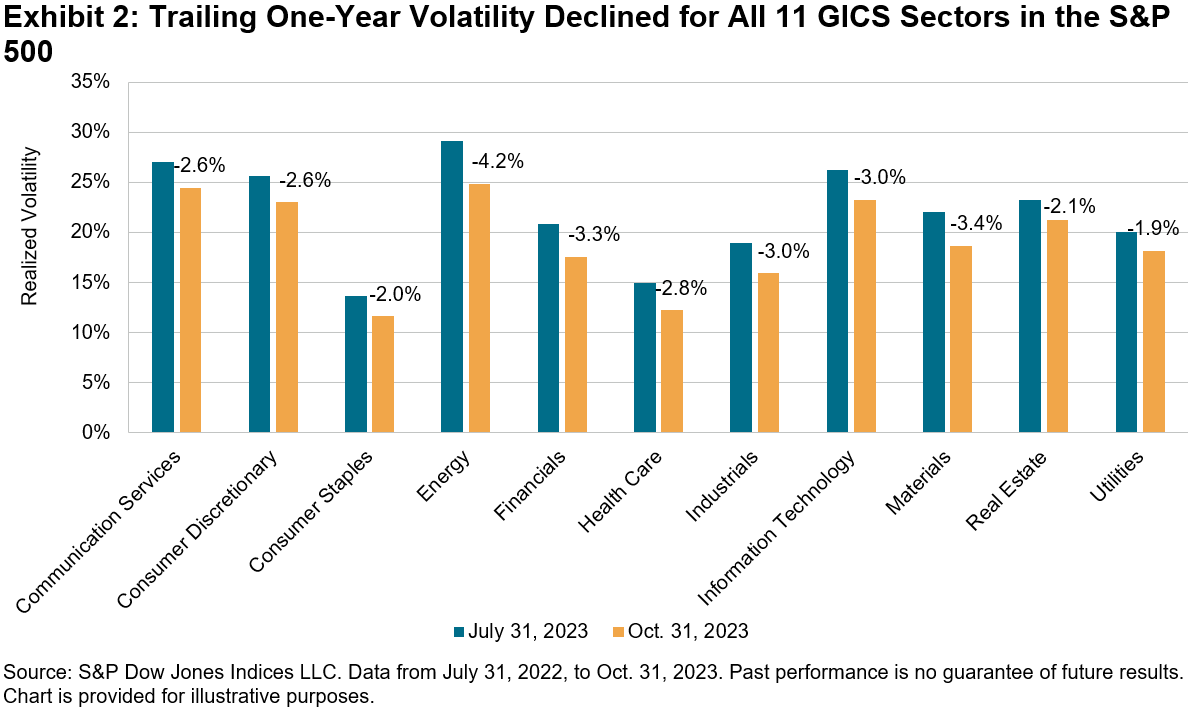

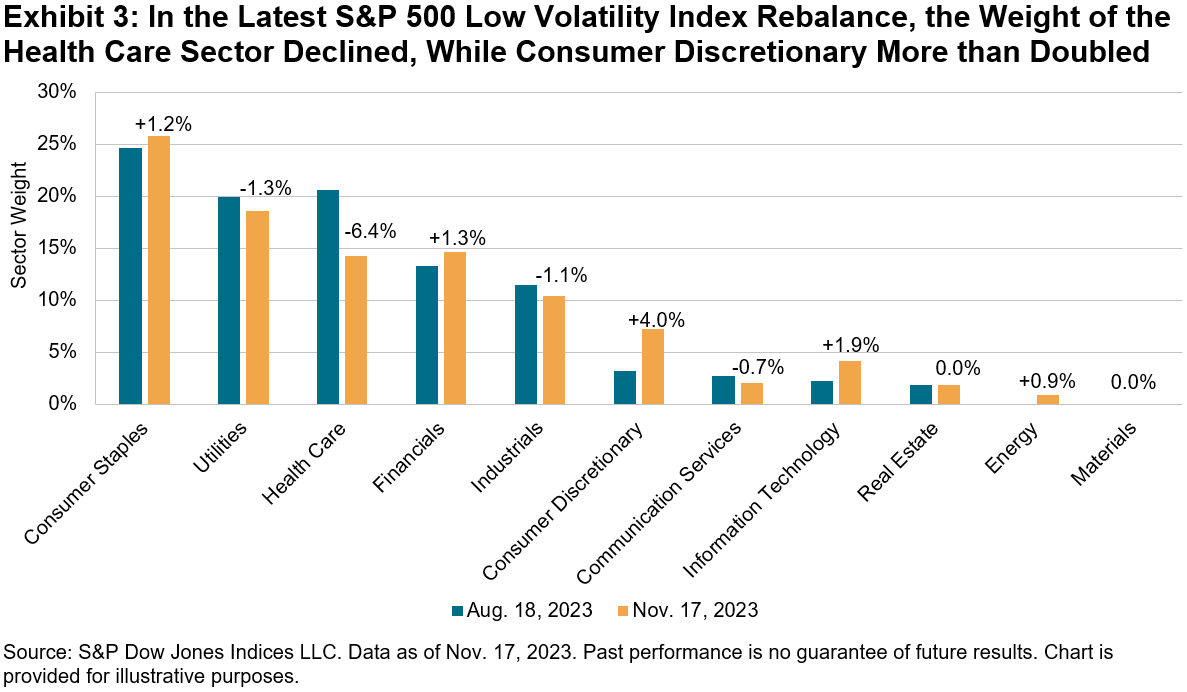

S&P 500 ®(* )continued its strong efficiency this year after publishing a 9.8% gain in a period of less than 3 weeks from Oct. 30 to Nov. 17, 2023. Throughout this duration, the 10-year U.S. Treasury yield dropped roughly 45 bps 1 and October’s year-over-year heading CPI inflation cooled to 3.2%. 2 As Display 1 reveals, given that the previous rebalance for the S&P 500 Low Volatility Index on Aug. 18, 2023, through the most current rebalance on Nov. 17, 2023, the S&P 500 was up 3.7%, versus a decrease of 0.4% for the S&P 500 Low Volatility Index. This kind of divergence can occur specifically throughout durations of strong efficiency and low volatility for the S&P 500. Throughout this duration, the annualized everyday basic variance for the S&P 500 was a reasonably low 13.6%. As Display 2 programs, the tracking 1 year volatility reduced for all 11 GICS sectors from July 31, 2023, to Oct. 31, 2023. The prevalent decrease in volatility throughout all 11 GICS sectors followed the exact same pattern in the 3 months prior to this duration. Determined in outright terms, volatility reduced the most for the Energy sector, although it stayed the most unstable sector at 24.9%. Since Oct. 31, 2023, Customer Staples was the least unstable sector, with an everyday understood volatility of just 11.6%. Amidst the total decline in volatility, the current rebalance of the S&P 500 Low Volatility Index brought some product modifications to sector weightings, most significantly in the Healthcare and Customer Discretionary sectors.

Following the most current rebalance, Healthcare’s weight came by 6.4%. Roughly 4.0% moved to the Customer Discretionary sector, more than doubling its weight to 7.3%. Other significant receivers were the Infotech sector, which saw its weight nearly double from 2.3% to 4.2%, in addition to the Customer Staples sector, which increased its weight to 26%.

After the Energy sector got a little allotment of roughly 1%, the Products sector is now the only sector without any allotment in the S&P 500 Low Volatility Index. The current rebalance ended up being efficient after the marketplace close on Nov. 17, 2023.

1

https://fred.stlouisfed.org/series/DGS10

2 https://www.bls.gov/news.release/cpi.nr0.htm

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

A Tactical Take A Look At Sectors Classifications

Equities

-

Tags

Anu Ganti, -

dispersion,

energy, GICS sectors, indexing sectors, liquidity, sector rotation, Select sector ETFs, choose sectors, Tactical Methods, United States FA How are consultants utilizing sector information to comprehend market patterns and notify financial investment choices? S&P DJI’s Anu Ganti signs up with Fairlead Methods’ Katie Stockton to talk about useful applications for sector indices. https://www.youtube.com/watch?v=9-MWc43uvRk

Senior Director, Index Financial Investment Method

® Leading 50 outmatching the S&P SmallCap 600 ® by 30% YTD. 1 As an outcome of its intrinsic small-cap predisposition, the S&P 500 Equal Weight Index (EWI) has actually suffered appropriately, underperforming the S&P 500 by 11% in the twelve months through October However as we observe from the troughs and peaks in Display 1, Equal Weight has actually constantly handled to recuperate from deep losses. February 2001, February 2010 and March 2021 are 3 prime examples, post significant occasions like the tech bubble, monetary crisis and COVID-19 economic crisis. While the method has actually damaged up until now this year,

we understand from Display 2 that Equal Weight tends to exceed over the long term The method’s little size, anti-momentum and worth tilts are crucial efficiency factors. Even More, Equal Weight’s inherent rebalancing system of offering the winners and purchasing the losers is a crucial advantage of the mean reversion we observe in Display 1. The dilemma at hand is that it’s tough to understand beforehand when the inflection point of outperformance for Equal Weight will take place. Historically, we have actually seen that turning points have actually accompanied extremes in mega-cap outperformance

We can envision this relationship by ranking the months in our database by the 12-month relative efficiency of the S&P 500 Leading 50 and dividing them into deciles. Next, we examine the average subsequent 12-month efficiency of Equal Weight in each of these deciles. We observe that lower decile S&P 500 Leading 50 months tended to be followed by Equal Weight outperformance in the next year, while greater deciles tended to be followed by Equal Weight underperformance. Presently, thanks to the supremacy of the Splendid 7

stocks, we are at high levels of mega-cap outperformance relative to history, with the S&P 500 Leading 50 outshining the S&P 500 by 9% in the 12 months through October, beyond the 10 th decile by a margin of 2%. Historically, we have actually seen that a retreat towards a lower decile tended to follow, accompanied by Equal Weight outperformance. Whether we experience a pullback in mega-cap strength or an extension in mega-cap momentum stays to be seen. 1 Efficiency since Nov. 17, 2023.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Tags 2023,

Senior Director, Index Financial Investment Method

” term has actually transcended its cinematic roots to end up being the cumulative name for a choose group of U.S. mega-cap stocks accountable for over 90% of the S&P 500 ®‘s YTD gets to October’s end. Their outstanding efficiency has, naturally, raised their appraisals. It has actually likewise increased their already-hefty cumulative weight in the equity criteria. Some might be questioning whether, instead of slavishly adhering to capitalization weights, is it now time to embrace an active method, taking revenues and preventing additional concentration? Sharp increases in stock costs have actually been rather regular traditionally, even amongst the marketplace’s relative giants. Sadly, such celebrations do not appear to present

simple methods to exceed— a minimum of evaluating by the cumulative proof of twenty years of S&P DJI’s SPIVA ® Scorecards However even if the time is ideal to offer, lots of financiers holding positions in the “Splendid 7” will have earned a profit on them. Over and above any prospective remorse for their rush, offering out might welcome another undesirable effect: a tax expense Just recently, we released a significant extension to the standard SPIVA library with the very first SPIVA After-Tax Scorecard

The report reveals that, to put it candidly: taxes matter. For instance, Display 1 (replicated from the report) reveals the effect of taxes on three-year underperformance rates by actively handled broad U.S. equity funds through December 2022. Is it various this time? The existing scenario is not uncommon. In latest years, the leading 7 factors 1

ended the year looking fairly pricey (see Display 2). An especially appealing contrast is seen in 2017. At that time, the so-called “FAANGs” dealt with a comparable degree of market hesitation, with P/E ratios balancing almost 3 times that of the index itself. As it ended up: the 7 leading factors in 2017 went on to contribute almost 40% of the S&P 500’s 9.9% annualized return from December 2017 through October 2023. 5 of them (consisting of 4 of the FAANGs) remain in today’s Splendid 7. If it were basic to understand when to offer relatively miscalculated stocks (in addition to when to purchase underestimated ones), actively handled funds may boast a much better record.

The addition of tax factors to consider just makes the proof more emphatic

And while specific tax situations vary, the SPIVA After-Tax Scorecard highlights that taxes might have made a considerable influence on the typical returns of actively handled U.S. equity funds. They likewise reveal that, in current times, the job of picking an exceeding active fund web of inadequately timed trades, charges and taxes was nearly (if not entirely) difficult 1 We acknowledge that 7 is rather approximate; why not 6 or 8? For the sake of consistency and with a nod to the modern discourse, we stick to the leading 7 factors in each historic duration and their tracking P/E ratios at that time.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Tags 2023,