imaginima

Nvidia’s stock has actually risen by around 240% this year thanks to its management position in the generative AI transformation. The AI market chance is unquestionably enormous, and the AI-related development story has actually just started. Numerous financiers appear to be focused on Nvidia’s remarkable AI chip, however it is likewise crucial to acknowledge the wider information center chance as an entire to really value the bull case for Nvidia stock. The tech giant has actually been releasing a fantastic sales technique, specifically through offering HGX systems, that makes it possible for Nvidia to efficiently take advantage of the marketplace chance ahead and lock clients into the Nvidia community for the long term. Nexus preserves a ‘purchase’ score on Nvidia stock.

In our previous post on Nvidia, Nexus described in a streamlined way the relation in between Nvidia’s hardware options and software application services, and how Nvidia has effectively developed its chips in a way that leads the way for enormous software application profits development potential customers. Nvidia’s market share in the AI chip market is approximated to be around 80%, gaining from a big set up base upon which it can develop a growing software application organization. Now in this post, we will explore another crucial motorist of Nvidia’s monetary efficiency, the sale of HGX systems, and how it cultivates Nvidia’s capability to take advantage of the marketplace chance ahead.

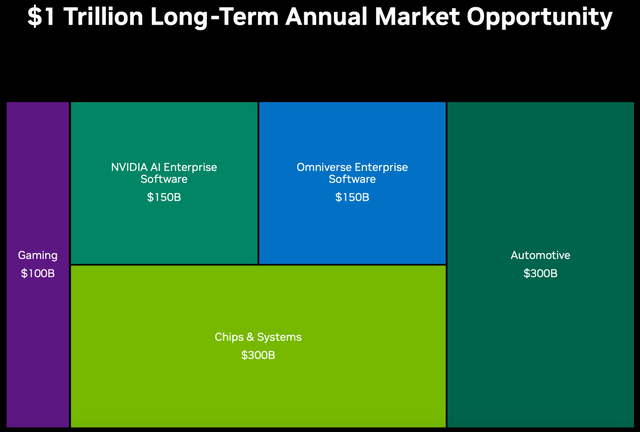

In September 2023, Nvidia forecasted its overall long-lasting yearly market chance to reach $1 trillion however did not define a target year for this quote. Although the business did provide a breakdown of anticipated market size chances for particular sectors.

For context, the business is anticipated to produce over $58 billion in profits this year, which would suggest considerable multiplicative development potential customers for Nvidia’s leading line moving forward. Now just how much of this $1 trillion market chance Nvidia will in fact have the ability to take advantage of is up for dispute.

Though focusing especially on the information center chance, which is Nvidia’s biggest sector and comprised 80% of overall profits last quarter, the business’s executives have actually highlighted how the high need for HGX systems has actually been a crucial motorist of profits development. On the Q3 FY2024 Nvidia revenues call, CFO Colette Kress shared:

” The ongoing ramp of the NVIDIA HGX platform based upon our Hopper Tensor Core GPU architecture, together with InfiniBand end-to-end networking drove record profits of $14.5 billion, up 41% sequentially and up 279% year-on-year.”

So what is the HGX platform?

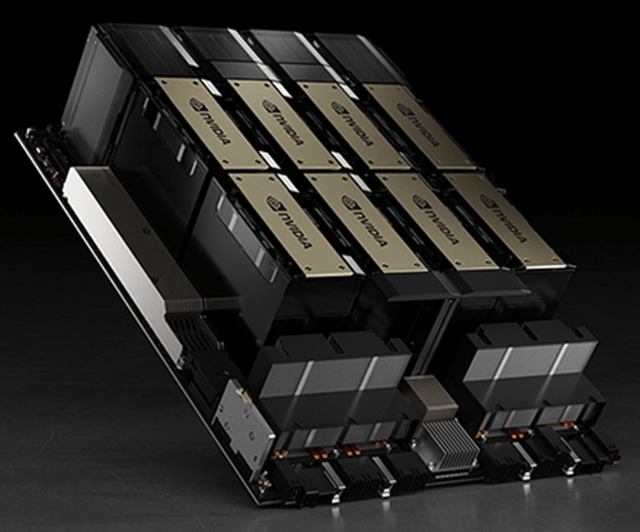

The HGX platform, likewise called Nvidia’s AI supercomputer, is constructed for establishing, training, and inferencing generative AI designs. It integrates 4 or 8 AI GPUs (such as A100s or H100s) together utilizing Nvidia’s networking options (Infiniband) and NVLink innovation and likewise consists of the NVIDIA AI Business software application platform.

Nvidia HGX supercomputer (Nvidia)

So basically, rather of information center clients needing to acquire different hardware elements independently, Nvidia integrates all the elements required for AI work into a single system. This is a fantastic item sales technique where Nvidia can cross-sell its other information center options, such as networking options, along with the sales of its extremely in-demand chips, as one huge bundled option.

In reality, on the Q2 FY2024 Nvidia revenues call, Kress had actually shared that:

” Strong networking development was driven mainly by InfiniBand facilities to link HGX GPU systems.”

On the last revenues call the CFO exposed that “Networking now surpasses a $10 billion annualized profits run rate”, which implies that Nvidia produced over $2.5 billion in networking profits last quarter.

So, when you become aware of Nvidia’s jaw-dropping information center profits development rates, bear in mind that these sales development numbers do not simply show the high need for its GPUs, however likewise other information center options that Nvidia is savvily cross-selling with its AI chips through HGX systems. Nvidia approximates the long-lasting market chance for ‘Chips & & Systems ‘( that includes HGX systems) to be $300 billion, and this bundled sales technique makes it possible for Nvidia to efficiently take advantage of this chance.

It deserves keeping in mind that information center clients typically tend to utilize a varied set of providers for chips and other hardware options, rather of purchasing all elements from a single provider in order to prevent supplier lock-in. For example, an information center client may acquire Nvidia’s GPUs, along with AMD’s GPUs, and after that integrate them together utilizing networking options from Broadcom. This is to prevent providing excessive prices power to a single provider, and having the ability to change providers more quickly if they discover a much better offer somewhere else.

Keeping this in mind, the reality that Nvidia has actually still had the ability to effectively motivate information center clients to acquire HGX systems rather than private chips/ networking options is a testimony to Nvidia’s remarkable AI options. This is what makes it possible for Nvidia to provide unbelievable year-over-year profits development of 279%, as the HGX system binds the tech giant’s different information center options together into one huge bundled item.

It basically permits Nvidia to lock end-customers into its community, leading the way for the chip giant to be able to cross-sell and upsell more AI options moving forward, especially its AI software application stacks. As talked about in the previous post, Nvidia’s software application services are higher-margin options, enabling earnings margin growth. Nvidia currently delights in strong prices power for its AI chips, with the H100 selling for costs varying from $25,000 to $40,000, which is boosting its bottom line. Now as software-related sales end up being a progressively bigger part of Nvidia’s overall profits moving forward, it must broaden the tech giant’s earnings margins even further. For context, Nvidia’s non-GAAP gross margin broadened from 71.2% to 75% last quarter.

Additionally, as business progressively utilize the HGX platform for their AI work, it consequently likewise motivates increasingly more software application designers to develop out software application applications particularly enhanced for Nvidia’s AI hardware options. This constantly advances the performances of Nvidia’s HGX platform and chips, which in turn draws in a lot more clients to utilize Nvidia’s AI options, thus producing a virtuous network impact. The tech huge jobs the marketplace size for its NVIDIA AI Business Software application to reach $150 billion on a yearly basis.

Moreover, as information center clients progressively purchase Nvidia’s total HGX systems rather of private chips, it controls the degree to which these clients purchase other information center options (e.g. networking devices) from rivals, making it harder for competitors to acquire share in the information center market. For context, around 30% of conventional information center clients’ capital investment is approximated to go towards Nvidia’s items next year.

Nvidia would wish to prevent its GPUs being gotten in touch with rivals’ hardware options in the celebrations where clients aim to develop their own computing systems (as discussed earlier), as it might possibly jeopardize or obscure the efficiency characteristics of Nvidia’s chips.

For that reason, increased sales of the HGX systems yield Nvidia more control over the efficiency of its chips, as they are incorporated with Nvidia’s own nearby hardware options like NVLink and Infiniband, enabling enhanced efficiency. This makes it possible for Nvidia to much better display the supremacy of its information center options working aggregately together, rather than when its chips are incorporated with rivals’ hardware items such as AMD’s chips and Broadcom’s networking options.

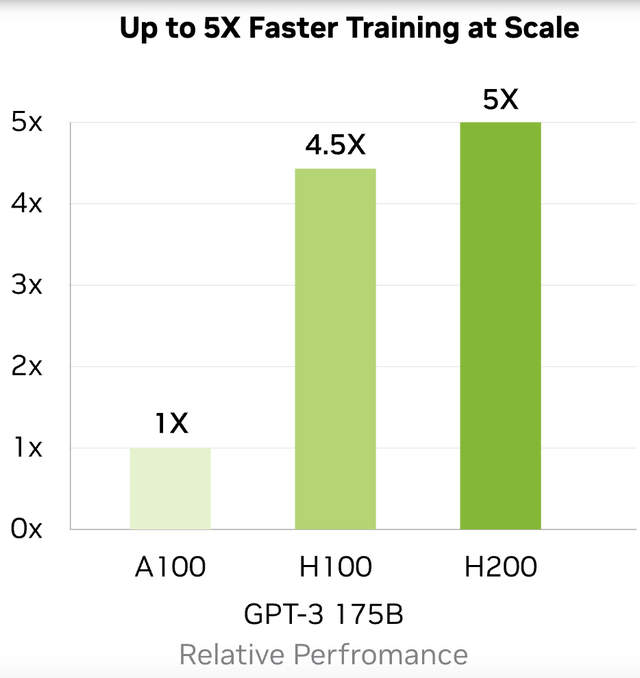

In reality, previously today, Nvidia presented an advanced AI supercomputing platform, powered by its most current H200 chips, which makes it possible for even quicker training and inferencing of AI designs.

Note: Efficiency contrasts are relative to Nvidia’s A100 (Nvidia)

The continuous AI transformation has business racing to establish, train, and reasoning their own tailored AI designs through their cloud companies, and release them throughout their own product or services as rapidly as possible. For this reason, it comes as not a surprise then that the leading cloud companies, “Amazon Web Solutions, Google Cloud, Microsoft Azure and Oracle Cloud Facilities will be amongst the very first cloud company to release H200-based circumstances beginning next year”, in order to meet clients’ requirements for faster and more effective training and inferencing.

Access to Nvidia’s most current AI options has actually ended up being a crucial competitive aspect amongst information center clients, in order to prevent losing clients to competitors, which ought to not just drive sales of the brand-new HGX H200 next year however likewise allow Nvidia to constantly broaden its software application community for additional earnings margin growth.

Dangers to think about

Information focus clients are still diversifying: It deserves keeping in mind that in spite of the high need for Nvidia’s HGX systems, other rivals offering information center options are likewise seeing need development.

On AMD’s Q3 2023 revenues call, CEO Lisa Su announced:

” Based upon the fast development we are making with our AI plan execution and purchase dedications from cloud clients, we now anticipate Information Center GPU profits to be around $400 million in the 4th quarter and surpass $2 billion in 2024 as profits ramps throughout the year.”

Moreover, Broadcom’s sales of networking options (e.g. switches and routers) grew by 20% year-over-year last quarter, showing that information centers are likewise wanting to link hardware options from various providers together, in the interest of some diversity far from Nvidia. In a previous post on Broadcom stock, we went over how:

” Broadcom develops its networking options in such a way that work effortlessly with chips from a range of suppliers, to permit enhanced efficiency and scalability, while helping in information center clients’ diversity technique.”

So, Broadcom will aim to assist clients develop their own computing systems that provide comparable, if not much better efficiency than Nvidia’s HGX systems.

For that reason, Nvidia will require to constantly show that its HGX systems offered as a total, aggregated option deal meaningfully remarkable efficiency over systems constructed with a varied set of elements, in order to preserve its market share supremacy.

Information focus clients are producing their own chips: All 3 significant cloud companies; Amazon’s AWS, Microsoft Azure, and Google Cloud, now have their own AI chips, as they attempt to decrease their dependence on Nvidia. In reality, in a previous post, we went over how Amazon’s AWS has actually currently had the ability to motivate AI start-ups to embrace cloud services powered by its own chips rather than Nvidia GPUs.

In Addition, while Nvidia is aiming to motivate increasingly more business to release their AI applications through the NVIDIA AI Business software application platform, cloud companies will be attempting to cause higher usage of their own AI-centric software application platforms for application advancement and implementation, challenging Nvidia’s capability to efficiently take advantage of the $150 billion market chance it anticipates for its AI software application options.

Now it will be hard for these cloud companies to entirely fend off their dependence on Nvidia offered the appeal of its CUDA software application library along with Nvidia’s own DGX cloud efforts to keep end-customers knotted to the Nvidia community. Nevertheless, cloud companies’ efforts to move more of their clients’ work onto their internal software and hardware options certainly controls Nvidia’s capability to efficiently take advantage of the marketplace chance ahead.

China chip curbs: the heightening competition in between the United States and China has actually led to a restriction on Nvidia’s capability to offer its AI chips to China. While Nvidia has actually brought out brand-new chips to work around these restrictions, it is not likely to stop Chinese clients from checking out domestic options, weakening Nvidia’s long-lasting sales development capacity in China. Last quarter, sales to China comprised 22% of overall profits. For this reason, aggravating relations in between the 2 countries will have a significant effect on Nvidia’s profits development potential customers moving forward.

Nevertheless, the enormous AI market chance ahead for Nvidia, consisting of the upgrade cycle for information center facilities around the world, along with the software application services chance, ought to assist control the lost profits effect from China.

Is Nvidia equip a buy?

In spite of the growing dangers, the growing sales of HGX systems allow Nvidia to strongly catch and sustain market share by offering its variety of information center options in an aggregated way through a single item, efficiently recording the $300 billion market chance in ‘Chips & & Systems’.

Moreover, the software application layer of the HGX platform, Nvidia AI Business software application, contributes to clients adhering to the Nvidia community over the long term. This highly positions Nvidia to take advantage of the approximated $150 billion AI software application chance and likewise increases the probability of information centers continuing to update and acquire the most recent AI hardware options from Nvidia, comparable to how an Apple iPhone user is highly likely to update to an advanced iPhone design thanks to the stickiness of the services. Nevertheless, financiers ought to still be careful of the slowing rate in sales of its GPUs and HGX systems moving forward as different information center clients start developing their own completing AI options internal.

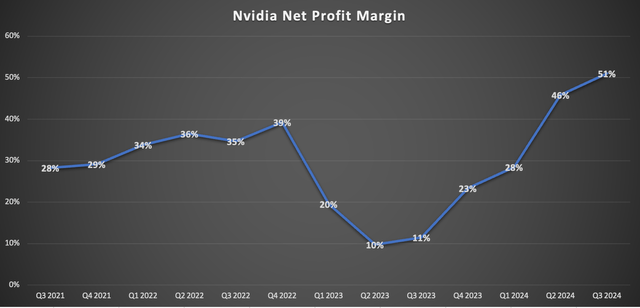

Now based upon Nvidia’s long-lasting market chance forecasts, a minimum of 30% of Nvidia’s long-lasting profits is anticipated to stem from software application services, which are higher-margin options that assist drive earnings margin growth. Last quarter, Nvidia’s GAAP web margin broadened to an impressive 51%.

Nexus, information put together from business filings

Throughout the Evercore ISI 2023 Semiconductor Conference, CFO Colette Kress shared that:

” Now our general software application that we are offering independently will likely reach near $1 billion this year. So it is scaling. It is scaling rapidly. This is essential for NVIDIA AI Business. That’s a crucial part of it. We likewise have our Omniverse platform. And after that long term, you’re likewise visiting self-governing driving be a crucial aspect of our software application profits too.”

Nvidia is approximated to produce around $58 billion in overall profits this , thus $1 billion in software application profits indicates that its contribution to company-wide profits is just in the low single digits. However as Nvidia’s profits structure progresses towards a 70% -30% split in between software and hardware, it strengthens Nvidia’s capability to sustain a net earnings margin of above 50%.

Now in regards to evaluation, Nvidia’s forward PE (non-GAPP) presently stands at over 40x financial 2024 revenues, and practically 25x financial 2025 revenues. For context, Nvidia’s 5-year typical forward PE is 44.94 x. For this reason, the stock is low-cost relative to its historic evaluation patterns.

Remember that the forward PE ratio does not consider the rate at which revenues are growing. For this reason, Nexus chooses the forward Price-Earnings-Growth [PEG] metric, where a business’s forward PE several is divided by the forecasted revenues development rate. The forward PEG ratio assists financiers examine how wonderfully the stock is valued relative to its forecasted development rates, the concept being that business with faster revenues development rates should have to trade at greater forward revenues multiples.

A forward PEG ratio of around 1 is reflective of a relatively valued stock. Though unsurprisingly premium stocks with appealing development potential customers hardly ever tend to trade at reasonable worth. Rather, the marketplace appoints a premium evaluation to such stocks, based upon elements such as market share supremacy, competitiveness of its products/services, and balance sheet strength.

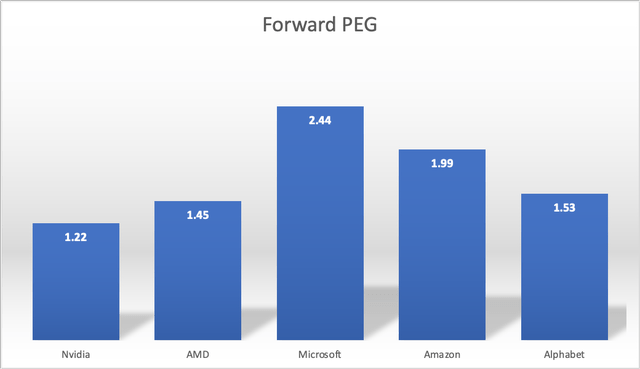

Nvidia presently trades at a forward PEG ratio of 1.22, which implies it trades at a 22% premium to its reasonable worth. This is less expensive than arch-rival AMD and the significant cloud companies that likewise stand to win huge from the AI transformation.

Information put together from Looking for Alpha

Now bear in mind that it is not uncommon for premium stocks to trade at forward PEG ratios above 2, as they are typically viewed as safe-haven financial investment securities.

The 5-year typical forward PEG ratio for Nvidia stock is 2.29, and the marketplace has actually traditionally been ideal to have actually appointed such a premium evaluation to the stock offered the tested competitive strength of Nvidia’s items and appealing development potential customers.

Now in spite of the monstrous rally in the stock this year, Nvidia just trades at a forward PEG ratio of 1.22, which is not just less expensive than other AI stocks however significantly listed below its historic average, leaving adequate space for several growth. Over the long term, Nexus thinks the stock must trade at a forward PEG ratio that is above 2 (closer to its 5-year average), offered Nvidia’s capability to strengthen its AI moat through software application services.

Nexus preserves a ‘purchase’ score on Nvidia stock.