everythingpossible/iStock by means of Getty Images

Financial Investment Thesis

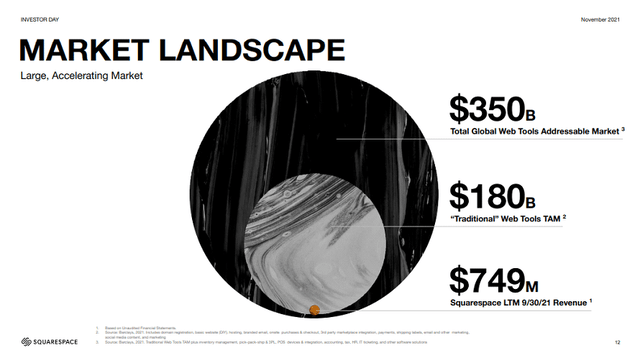

I have a favorable view online tools subsector and the item offering of Squarespace, Inc. ( NYSE: SQSP). The adoption of e-commerce is driven by nonreligious patterns, which will add to the development of a multibillion-dollar addressable market. Nevertheless, keep a hold score on the stock in the medium term due to its earnings development being lower than peers, regardless of its smaller sized scale and the possibility of unsustainably high gross/EBITDA margins. Furthermore, the possible worldwide macroeconomic downturn, increased competitors from brand-new entrants, and greater external expenses for tradition services are all aspects that position dangers to the market’s development and success.

Business Summary

Developed in 2003, SQSP offers cloud-based software application services for site structure and e-commerce, permitting its customers to construct brand names and negotiate with their particular consumers. SQSP is concentrated on simpleness and ease of usage, both in site structure performance and total site visual.

Q1 2023: Assistance Raised on the Back of a Strong Quarter

The business provided a strong efficiency in the very first quarter of 2023 throughout different elements of business, driven by much better consumer acquisition, effective modifications to the attribution design, and enhanced efficiency in global markets. The management highlighted the core strength of the site, which led to a 16% year-on-year development in reservations for the very first quarter and a modest boost in the earnings assistance for the complete year. Furthermore, the CEO pointed out the upcoming release of text generation improvements powered by OpenAI, which will be offered to all consumers in the coming weeks.

Worldwide markets are adding to customer development, with similar earnings development rates for the United States and global markets. Nevertheless, the typical earnings per user (ARPUS) is not as strong as anticipated, regardless of rates actions and double-digit development in other top-line metrics. This might enhance as non-USD consumers get a cost boost later on in the year. In general, the favorable earnings development, healthy margins, and the resistant nature of costs in this classification make SQSP and comparable web tool business appealing to financiers, particularly in the face of unpredictable macroeconomic conditions.

Appealing Chance However I Stay Careful in the Medium-Term

I have a favorable outlook for the web facilities market over the next couple of years. SQSP can take advantage of a huge chance to target the share of sites that presently are not utilizing CMS by using users, even with little-to-no technical abilities, the capability to produce expert sites within minutes. Research study has actually revealed that services with professional-looking sites are viewed as more trustworthy, which will likely drive increasing need for website-building tools. Furthermore, there are over 332 million little and midsize services internationally that might be possible consumers for SQSP.

Nevertheless, I acknowledge that web facilities business might deal with difficulties in attaining their development targets in the medium term due to possible monetary restrictions for customers in a tough macroeconomic environment. Most of SQSP consumers are independent people who might postpone their entrepreneurial aspirations when dealing with high expenses of capital and external unpredictabilities. While I anticipate small companies to continue utilizing domain and hosting services (comparable to how they would not detach their phone lines), it is not likely that these consumers will strongly increase their typical costs by taking in more services and add-ons. This might lead to a deceleration of formerly set earnings development targets for these business.

Furthermore, there is a threat of increased competitors from brand-new gamers, consisting of popular tech brand names. If significant web business choose to buy ending up being more powerful rivals in the web advancement area, it might have an unfavorable influence on the success of existing web facilities business. In general, these aspects add to my mindful position on the medium-term outlook for the web facilities market. The possible worldwide macroeconomic downturn, increased competitors from brand-new entrants, and greater external expenses for tradition services are all aspects that position dangers to the market’s development and success.

Service up-sell chance

Web facilities business use their consumers a variety of extra organization applications to boost and promote their online existence. GoDaddy Inc. ( GDDY) is a significant reseller of Microsoft 365, while Wix.com Ltd. ( WIX) and SQSP resell Google Work area. Through revenue-sharing contracts with Microsoft and Google, these business end up being the main consumer assistance contacts, supplying much faster and more customer-oriented assistance through devoted call centers compared to the significant suppliers.

Apart from productivity-enhancing functions, consumers likewise look for tools to make their sites or online shops appear more expert. This consists of functions like having actually e-mail accounts connected with their authorized domain. Furthermore, there is considerable need for payment tools and services that allow smooth online and offline sales of services and products. Consumers likewise try to find support in curating marketing projects and developing an expert existence on social networks platforms. Additionally, consumers look for special-purpose add-ons such as scheduling abilities or unique locations of their site for paid customers.

Conclusion

I think that the site and e-commerce management sector holds pledge, and SQSP is placed well within this area. The long-lasting potential customers are brilliant, driven by nonreligious patterns connected with the increasing adoption of e-commerce, which broadens the addressable market into the multibillion-dollar variety. Nevertheless, in the medium term, I keep a mindful position due to the possible effect of macroeconomic patterns on total earnings development.