Edwin Tan

Intro

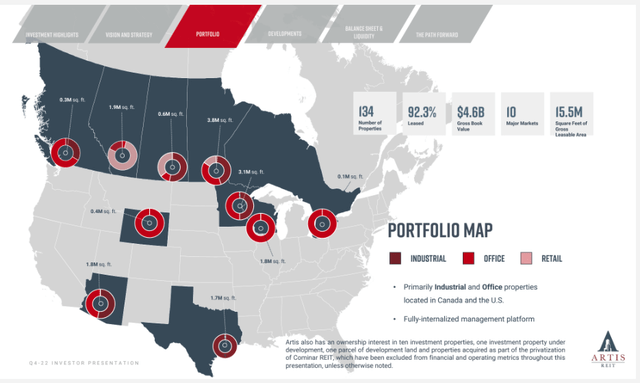

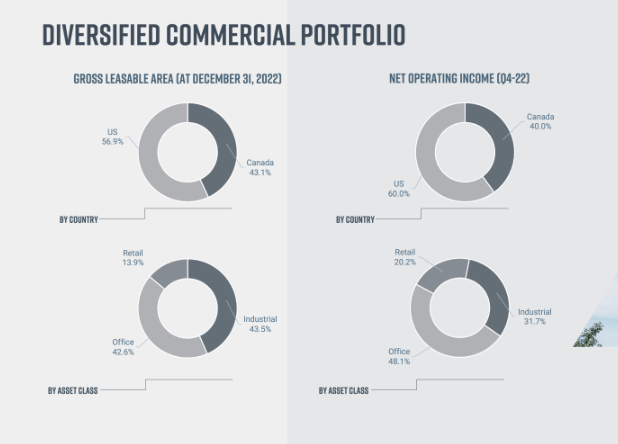

Artis Property Financial Investment Trust ( TSX: AX.UN: CA) is a varied REIT that owns 134 residential or commercial properties with a $4.6 Billion Gross Worth. Residence include commercial, workplace and retail area in The United States and Canada. 56% of GLA and 60% of NOI originates from the U.S.A. while the rest originates from Canada. Although commercial area represent the majority of the GLA it just represented 31% of NOI whereas workplace represented 48% of NOI.

Q4 2022 Financier Discussion (Artis REIT) Q4 2022 Financier Discussion (Artis REIT)

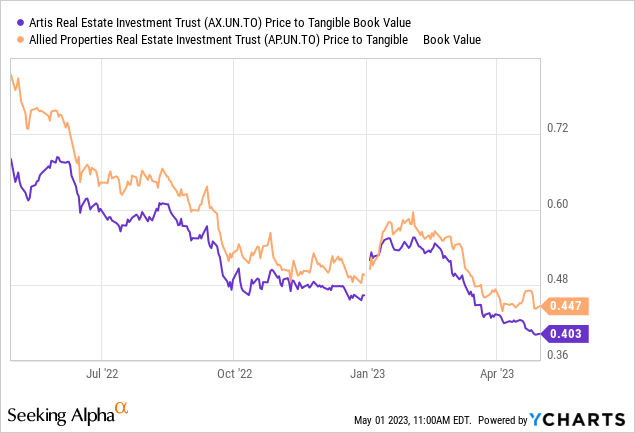

Although the REIT has substantial workplace direct exposure it captured my interest due to the fact that it trades at nearly the very same assessment as Allied Characteristics REIT ( AP.UN: CA) yet Allied is a pure-play workplace REIT and Artis has 32% direct exposure to the a lot more preferable commercial area where need has actually been skyrocketing in The United States and Canada and 18% direct exposure to the not as preferable retail area.

Although I do have my bookings about workplace in the present environment, a 40% discount rate to NAV for a varied REIT with a 9% yield does look attracting.

Financial Investment Thesis

In March 2021, the REIT started a “Service Change Strategy” which has 3 objectives to improve system holder worth. The very first objective is to reinforce the balance sheet through accretive personalities, system repurchases and financial obligation decrease. The REIT has actually opened worth through the money making of specific possessions, consisting of the majority of its commercial possessions in the Greater Toronto Location, Ontario and the Twin Cities Location, Minnesota, and the REIT’s staying workplace residential or commercial properties in Calgary, Alberta. The REIT has actually offered 48 commercial residential or commercial properties, 11 workplace residential or commercial properties, 6 retail residential or commercial properties and a part of a retail home. The REIT likewise bought 387,068 systems at a weighted-average cost of $8.94 under the term which depended on 50% listed below NAV.

The 2nd objective of business Change Strategy is driving natural development through determining functional effectiveness, increasing tenancy and in-place leas, and the conclusion of brand-new advancement tasks.

The 3rd objective of business Change Strategy is to concentrate on worth investing, which includes redeploying capital into brand-new financial investments consisting of underestimated openly traded property securities and any other property financial investment chances. In Q1 of 2022, Artis got 32.64% of Iris Acquisition II LP (” Iris”) for $112 Million, an entity formed to get the exceptional systems of Cominar, and $100,000 of junior chosen systems that bring a rate of return of 18.0% per year.

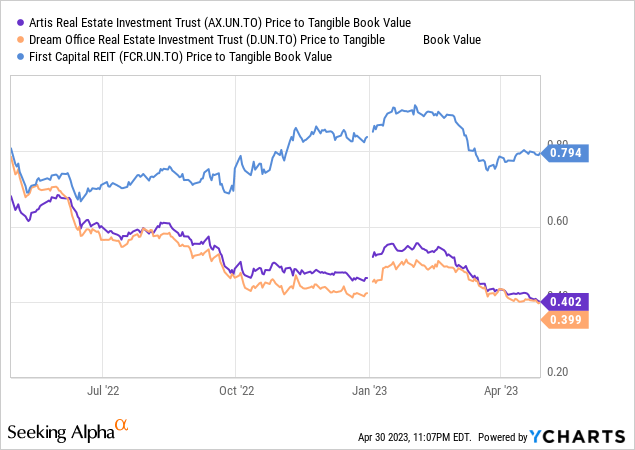

In December 2022, Artis got a 14% ownership position in Dream Workplace REIT ( D.UN: CA) and a 9% interest in First Capital Property Financial Investment Trust ( FCR.UN: CA).

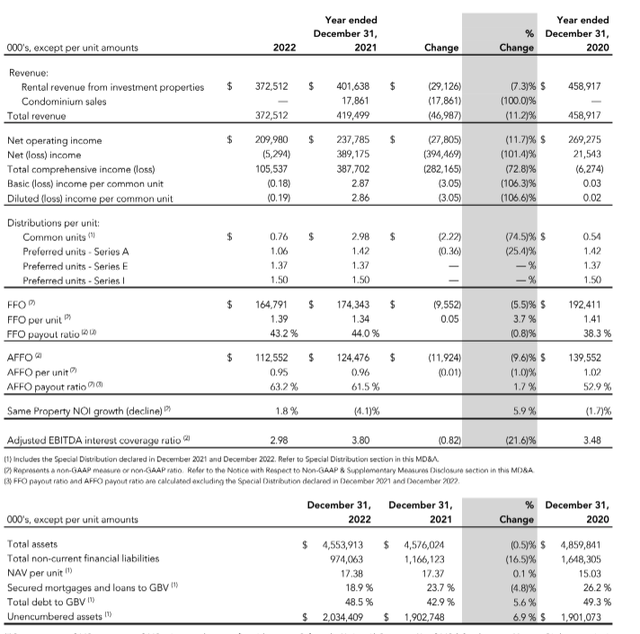

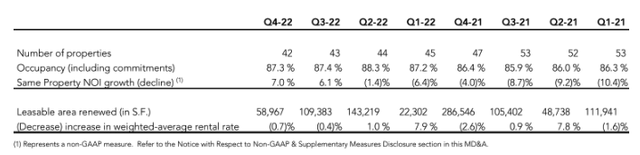

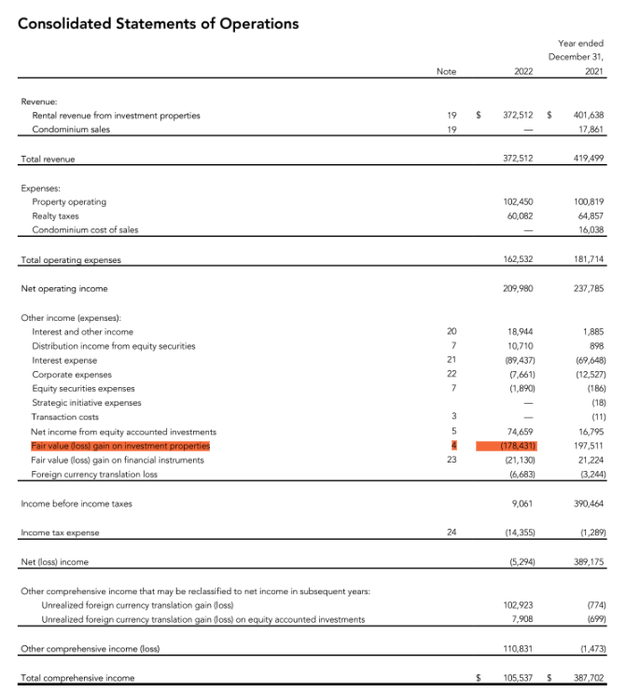

2022 FYE outcomes revealed some indications of success as tenancy was steady at 90.1%, increasing from 89.4% at December 31, 2021. In 2022, 982,778 square feet of brand-new leases and 1,456,537 square feet of renewals started. These renewals were worked out at a weighted-average rental boost of 4.9% which helped in very same home NOI increasing 5.9% YoY. The strong U.S. dollar relative to the Canadian dollar as the typical currency exchange rate of 1.3017 in 2022, compared to 1.2537 in 2021 likewise assisted NOI. The effect of each is hard to separate, however the latter might be less most likely to assist in 2022. FFO and AFFO were basically flat.

2022 Yearly Report (Artis REIT)

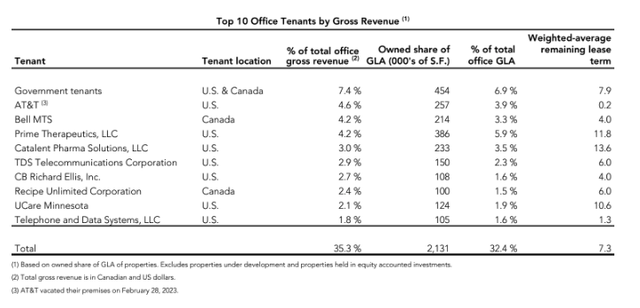

When looking under the hood at tenancy and renewals on workplace, these numbers have actually not been half bad considering that 2021 with tenancy at 86% -88% and flat however often even favorable leasing renewal spreads in some quarters. In reality the portfolio is not dreadful either with ~ 7% of the renter mix being federal government firms and ~ 9% being financial investment grade telecom giants such as AT&T ( T) and Bell MTS ( BCE). The weighted typical lease term is relatively high at 7.3 years.

2022 Yearly Report (Artis REIT) 2022 Yearly Report (Artis REIT)

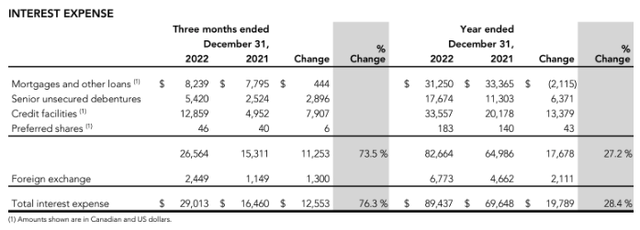

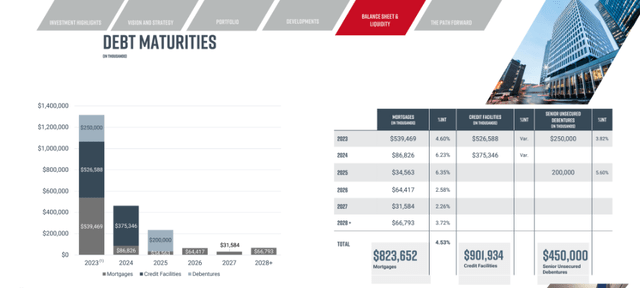

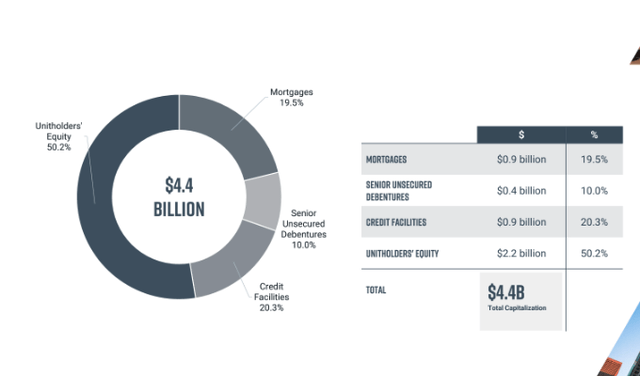

There is little doubt that increasing rates of interest will cause some discomfort in financial 2023. Interest cost was 76% YoY in Q4 2022 relative to Q4 2021 as interest on the credit centers nearly tripled. Artis is more exposed to increasing rates than any REIT I have actually seen with $900MM in variable rate financial obligation on its credit centers and 65% of home loan financial obligation up for renewal in 2023. These rates are on a quick upward trajectory till 2025 prior to they begin to come down once again. Keeping an eye out to 2023, year over year interest expenditures might increase a minimum of 30%. Utilize is not precisely low either with debt-to-EBITDA at 8.3 x and debt-GBV at ~ 49% however this is still much better that Allied Characteristics with debt-to-EBITDA being over 9x.

2022 Yearly Report (Artis REIT) Q4 2022 Financier Discussion (Artis REIT)

On February 4, 2022, the REIT paid back $100,000 of the $200,000 non-revolving credit center that developed on that date and participated in a changed contract for the staying balance of $100,000 with a maturity date of February 6, 2023. On Might 31, June 27, August 8, and December 1, 2022, the REIT participated in modified arrangements for the other 2 unsecured nonrevolving term credit centers in the aggregate quantity of $300,000 with the maturity dates reached December 1, 2022 and July 18, 2023. On December 1, 2022, the REIT participated in a changed contract to pay back $50,000 of the $150,000 nonrevolving credit center that developed on that date and extend the maturity dates of the staying balance. An additional payment of $50,000 was made on December 30, 2022 with the staying $50,000 developing on February 1, 2023. Describe Subsequent Occasions area of the MD&A for more modified arrangements subsequent to December 31, 2022.

Source: 2022 MD&A

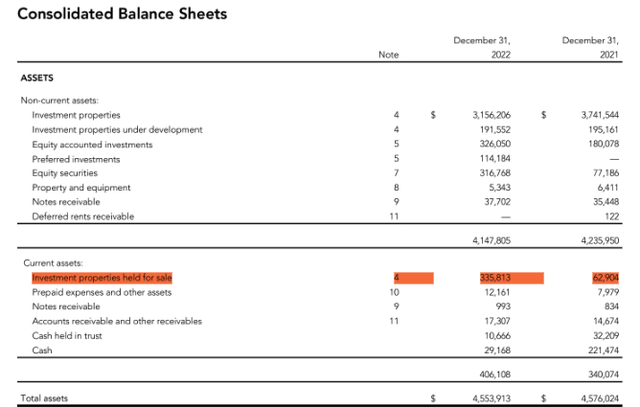

Management has actually likewise verified that of the $540 Countless home loan financial obligation that is up for renewal in 2023, 28% of it is verified to be extended, 22% will be settled with personality profits and 50% will be restored. This financial obligation looks less intimating when we think about the non-mortgage (home level) financial obligation is modest in relation to overall approximated reasonable worth of the portfolio. Safe home mortgages and loans just comprise ~ 19% of GBV and there is $2.0 Billion in unencumbered possessions which might be offered to pay for financial obligation. In reality, at 2022 FYE there was $336 Million in residential or commercial properties held for sale with 6 commercial residential or commercial properties in the Twin Cities and one in Saskatchewan that are held for sale with conditional sales arrangements.

Q4 2022 Financier Discussion (Artis REIT) 2022 Yearly Report (Artis REIT)

Regrettably increasing rates of interest have actually led to modest loss on sales of these residential or commercial properties.

2022 Yearly Report (Artis REIT)

Decision

I ‘d choose Artis redeem its own inexpensive stock instead of that of other REITs such as Dream Workplace provided its direct exposure to commercial area which has actually been on a rally without any end in sight. I definitely support Artis’s method of possession personalities followed by accretive share buybacks and accretive possession acquisitions, and even purchasing openly traded REITs listed below NAV as this must lead to a boost in its own NAV as worth gets opened, even if it needs to offer present residential or commercial properties at a small loss.

Figuring out the payment ratio for 2023 is hard with all the personalities and the lower possession base integrated with the share buybacks however the Q4 2022 payment AFFO payment ratio was 78% which is a more conservative procedure as it subtracts the huge leasing expense reserves which perform at $31 Million a year. The payment ratio is up from 55% in Q2 of 2022 revealing that increasing rates are affecting the payment ratio. I am comfy with the dividend protection at present rates however higher rate walkings even in the 50 bps variety might put the dividend protection in concern and put the brakes on their Service Change Strategy.